Your house didn't get more expensive ... your money got less valuable

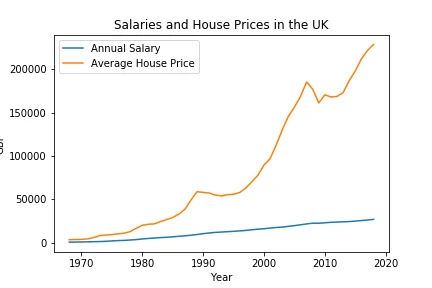

Over the last 40 years the average age of first time homebuyers in the UK went from 29 years old to 38, driven by a sharp widening in average house price and the average wage.

House prices vs gold

In 2003 the average UK home price was £135,000 at which point the price of gold was £320/ounce. So the average home cost 421.8 ounces of gold.

In 2024 the average UK home price is £290,000 and the price of Gold was £1700/ounce. The average home now costs only 170 ounces of gold.

In 20 years the price of gold. went up approx 5.3x while house prices went up 2.1x.

Thus in fact the average price of a UK home has fallen in terms of gold prices by 40% over the last 20 years!

Gold has historically been a store of value because of its scarce nature, gold can not be produced at will and thus gold rises in value as the purchasing power of our currency falls.

Investors on average who saved in sound money outperformed the best property investors over what has been the largest increase in house prices we have seen in history...!

Sound money is money that is stable in value, and is not subject to sudden decreases in value. 2 key properties of sound money are that it is not subject to monetary inflation and that it is not controlled by any single entity or government and thus its value is determined by the market.

In 2003 average wages in the UK were £21,124 while in 2024 they have risen to £37,430.

However when we adjust 2003 wages to account for inflation and thus to maintain purchasing power average wages in 2024 would need to be £41,599 ! (source - https://www.officialdata.org/uk/inflation/1765)

So not only have house prices doubled since 2003, our wages have not kept up and in fact when judged in terms of purchasing power(the amount of stuff you can buy) the average worker in the UK is far worse off.

So what is actually going on !

As we have discussed in prior blog posts, the purchasing power of our fiat currencies has diminished at an alarming rate driven by monetary inflation. The Truth About Inflation

Fiat currency is a type of money that is legal tender and issued by a government, but is not backed by a physical asset like gold or silver. Instead, its value is based on the public's trust in the government that issued it.

In 1971 Nixon removed the final formal relationship between money and Gold and it is since then that this phenomenon of monetary inflation became to be such a plague on humanity. Resulting in a loss of productivity, lowering of real wages, increases in income inequality and the dreaded affordability of housing.

The following website paints an alarming picture of the impact on our lives since we moved from sound money systems to fiat money controlled by governments and central banks: https://wtfhappenedin1971.com/

There is reason then to be angry and frustrated with the flaws of the systems. The Fiat monetary system has failed us and it is time for us all to understand how and why?

We are now beyond the point of return in this tale of an unstoppable debt machine that fuels the world economy. It will continue to tax its workers in new ways until all value and wealth is taken from soceity and ends up in the hands of the very few.

The world has shown its colours, looking around us we know that there is something broken but we aren't sure what and why. They blame the immigrants and poor people just as they warned us they would at the end of "The Big Short". Except the world didn't want to listen to the words being spoken in that scene when we first watched it...

It all doesn't make sense to us but we have been convinced not to look in the right places.

Weren't technological improvements meant to make our lives better? Or have we just accepted this reduction in quality of living, where we work harder for less.

Meanwhile we live in a world where stock markets are at all time highs in price while we have the greatest numbers living in homelessness and poverty.

The Fiat system uses the money printer and debt machine which fuels it to always bail out the large governments and institutions. It will continue to fund wars and weapons each one at a cost to all of us. Each new debt to pay for the prior debt all comes at a cost to us through inflation and debasement - except we haven't yet understood it.

We haven't asked where the money comes from and where all the prior money has gone when governments say they must raise taxes.

Each time this money printer is used more and more wealth is transferred from the majority to the ever-exclusive minority via rising asset prices and inflation.

Asset prices will outperform inflation as they have done in the past, this is why stocks, gold and property have always gone higher in price when measured in our diminishing currencies.

As the saying goes, follow the money..

So this blog post is a plea.

A plea to ask the difficult questions and to open our eyes to the movements of the world.

A plea to plan for your futures. A commitment to saving what you can and investing it to protect yourself from a devaluing currency.

It is confusing, money is meant to be. It was designed that way.

Yet we spend our whole lives trying to earn it. We give up time spent with family and friends to earn it. But we don't spend the time to learn how to look after and protect it.

But really we shouldn't have to know how to invest in order to "beat inflation" - our money should hold its value over time, so that the energy we put into earning it retains its value over time. That's how money should work...

It should feel like it's valuable.

It is an exchange for the energy and effort we put into our Jobs during our peak years. But money doesn't feel valuable to us anymore. And because of that we are subconsciously less inclined to want to save it.

But this is how it works. SO we can no longer stand aside and ignore it.

State support for our retirements is only going to continue to reduce over time and it is clear that taxation will continue to rise to pay for governments prior excesses.

So if we continue to do nothing and hope that things will work themselves out we will be setting ourselves up for failure. It is only by action now and saving for our futures can we ensure our own future financial security.

So what can we do ?

Stage 1 starts with budgeting and planning, by knowing your income and earnings and taking a keen interest in your expenditure you can begin the process of putting money away into investments.

This requires sacrifice, a sacrifice to forgo current spending and invest it in your future. Every Pound saved now is a brick for your future.

Stage 2 requires knowledge of how to allocate our savings.

Keeping money in our bank accounts is not a viable solution for protecting wealth, history has shown us that money loses value over time and thus saving in cash leads to lower future purchasing power.

Remember that bank's only have to hold 10% of your deposits and can lend out 90% of your deposits. What happens if everyone goes to take their money out at the same time? Why the money in your bank account doesn’t really exist...

Saving money requires us to be investors to protect the purchasing power of the money we worked so hard to earn.

This is the hard part - we aren't all investors, and there is always a fear that the value of our investments will fall. Thus it is vital for us to understand the thesis behind the investments and make wise and informed decisions.

This is not about getting rich quickly - investments which offer life changing gains in short periods of times are generally scams, but with compound growth on our side it is the time in the market and steady gains over the years that help to build larger pots of wealth. Compound growth - The 8th wonder of the world

Stocks and investing in assets such as gold have historically protected investors against the rising inflation around us. These will continue to be important vehicles of investing. We talked about this in Stocks 101 - Investing Ethically in the Stock Market. Pensions are generally the most efficient way to invest in stocks as we described in A Guide To Pensions.

However these investment solutions work more as band aids against the system that is built around us. We should by now be starting to understand that the monetary system is broken and that if you can fix the money you can start to fix some of the world.

We buy stocks as a hedge against inflation rather than an investment in a company because we believe it is undervalued. That's generally not the right reason to buy a stock.

And thus we must also look beyond the traditional assets to find solutions and alternatives that work better than our money.

Bitcoin provides a potential alternative monetary system - one which can not be manipulated by governments, is not controlled by politicians, does not discriminate, can not be printed and does not rely on debt to exist. A money which is finite and borderless , private yet verifiable and offers us all an opportunity to support a better form of money.

As we discussed in The Truth About Bitcoin - understanding Bitcoin requires re-education of what money actually should be.

So this plea ends with another plea ... Study Bitcoin, and understand what it is and how it works before you dismiss it. There is a reason it has been the best-performing asset for the last 15 years. But holding it requires understanding.

Resources to start your Bitcoin journey:

How does Bitcoin work: https://river.com/learn/

The Bitcoin Standard: https://www.amazon.co.uk/Bitcoin-Standard-Decentralized-Alternative-Central/dp/1119473861

How Bitcoin Can Help Muslims Follow The Teachings Of The Quran: https://bitcoinmagazine.com/culture/how-bitcoin-supports-muslims-and-the-quran

God Bless Bitcoin Documentary:

What's The Problem? - Demystifying why we all need Bitcoin - Joe Bryan:

Member discussion