Why the money in your bank account doesn’t really exist...

Before you go on, please make sure you have read the introduction to this article found here: The WORLD is built on debt... what's going on?.

In that article we explain the problems associated with money printing & the consequences on an economy. We explain why increases in money supply help the wealthiest most and act as a regressive stealth tax on the majority.

In this article we explain:

- HOW this money is printed.

- What is fractional reserve banking (and why the money in your bank account doesn't really exist)

- The implications of high debt

- How can we protect ourselves

- Islamic perspective

How does a country print money

Since the 2008 financial crisis we have often heard in the media the term Quantitave Easing (QE) – but what is it really? And how do central banks increase the money supply?

Mechanics of Money Printing & Fractional reserve banking:

This is a pretty broad and technical subject, but we will break it down into a simplified explanation (the short Youtube videos linked help to demystify these subjects further) :

- When a central bank prints money (QE) it doesn’t need to physically print notes, rather it is simply an entry into its balance sheet ledger. This new digital creation of money is used to buy bonds and assets from Banks who act as intermediaries. Often the central bank is buying debt of the government – monetizing its own debt to increase liquidity into an economy.

- Bonds are effectively loans taken by governments and companies to fund investment and spending. The outstanding UK government debt issued primarily as bonds stands today at £2.6trillion.

- The bonds are bought off bond holders (Institutions and Commercial / Investment banks) The Banks are then able to lend this money to others as it has higher cash reserves and operates under a fractional reserve banking system(more on this to come)– this creates a multiplier effect which injects liquidity and cheap money in an economy which drives higher nominal growth measured by GDP.

- The 'independent' Bank Of England has therefore purchased UK government debt which acts as a subsidy to the government enabling further govt spending and thus driving economic growth.

QE Youtube explainer video: https://www.youtube.com/watch?v=llslyXPu6wI

Fractional reserve banking?

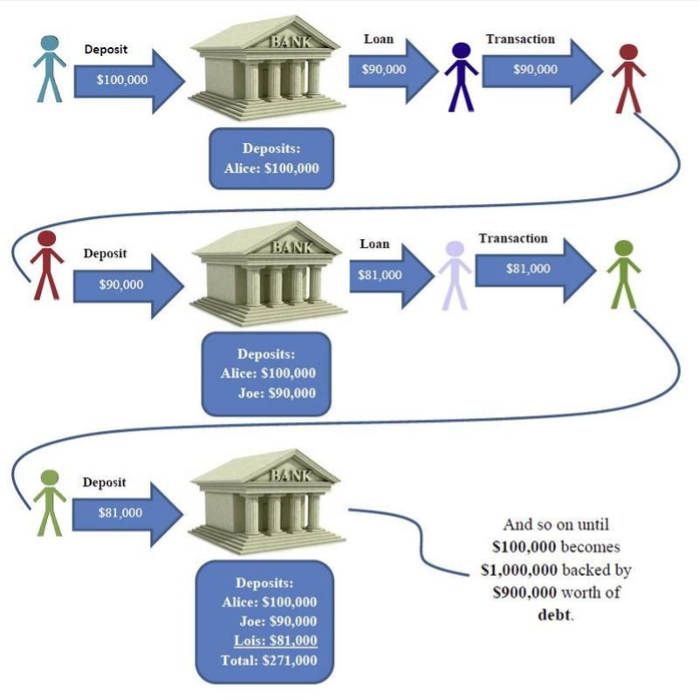

Fractional Reserve banking refers to the form of banking used in all developed countries. Essentially banks are only required to hold 10% of customer deposits. But this leads to an incredible outcome called the Money Multiplier (the infinite money glitch) where Banks recycle a single deposit into infinite new loans backed by no new underlying capital. This is shown in this simple example below :

You can see above how a single initial deposit into a bank of $100,000 is converted into $900,000 of new money(debt)

This process of depositing and lending creates new money from one single deposit. Every time a bank makes a loan to a business or individual new money is created out of thin air – driving higher money supply and thus inflation in an economy.

Commercial banks are the largest creators of money in an economy and hold the largest amount of liabilities.

What happens when every depositor goes to the bank to get their money back ?

(hint – it doesn’t exist in reality)

The majority of money in the world is created via this process and doesn’t actually exist .. when you look at your £10 bank note and it claims a promise to pay the bearer 10 pounds, what does the £10 mean and what is it backed by?

Modern monetary systems rely on trust in a government and central banks to honour their debts. There is no intrinsic underlying value to our money beyond this trust.

Youtube explainer for fractional reserve banking : https://www.youtube.com/watch?v=hPsRe6zILQU

Financial Services Compensation Scheme (FSCS):

In 2008 there were large scale scares with the banking system and UK institutions such as Northern Rock as depositors rushed to branches to withdraw their money, the government introduced the FSCS which promises to protect up to £85,000 of deposits in the event of a bank failure/run.

Consider where would this new money come from to pay off depositors?

- The central bank would be forced to print new money to pay off these obligations – which would further devalue the currency.

- In this situation you will receive your money back, but what will be the value of this money in purchasing power

- It is more than likely that this would lead to a catastrophic devaluation of the currency and hyperinflation making the nominal value of the money much less valuable.

Implications of High debt:

Over the last 30 years we have seen a rapid rise in money supply and debt across the world. As with all things, money that has been borrowed must be repaid and is a cost on our futures. the Uk total government debt currently stands at 84% of total GDP/year. I.e the total value of debt is equal to 84% of the total amount of revenue created in any transaction in the UK.

Remember that the total debt in the system is actually much higher.. the Govt debt acts as a deposit in commercial bank accounts which because of fractional reserve banking is multiplied further.

- As we approach the current July 2024 UK elections you will hear a lot on the various economic policies, but these governments are now constrained by the prior inherited debt burden and thus unable to direct new money into the key areas of the public sector.

- Thus arguing about current taxation misses the point of the current economic backdrop. The more pressing concern for us all is the debt burden left upon us by past leaders.

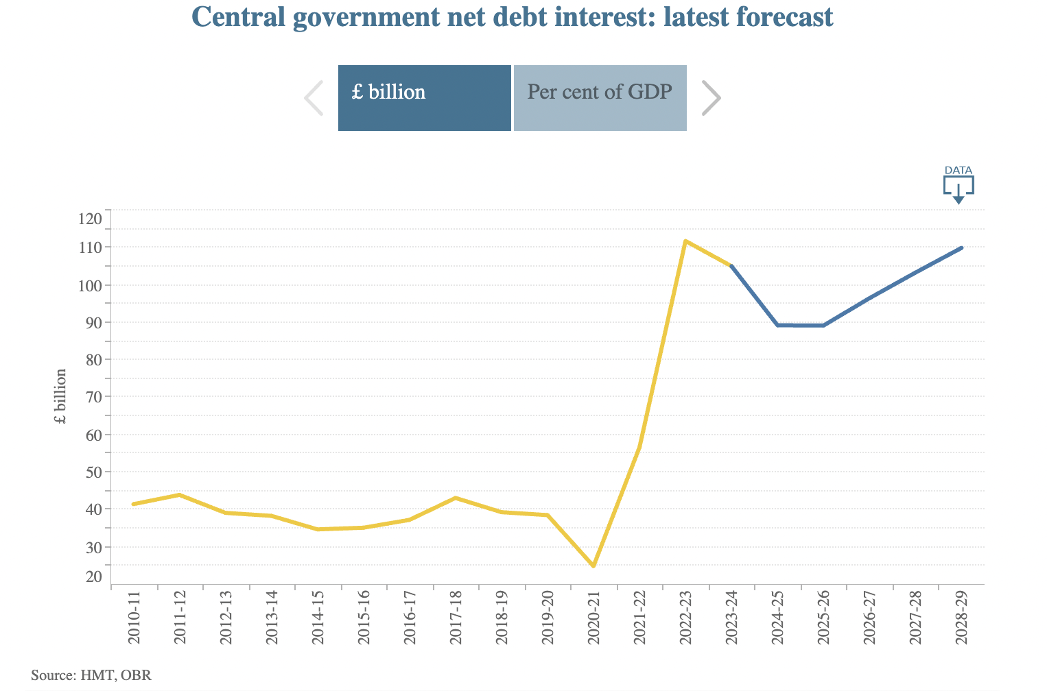

The chart below shows the rising debt burden of the UK national debt where more of the tax revenues collected are now used to finance past debt obligations and cripple a government into new spending.

This is just showing the rising cost of interest on prior debt. Our taxes are used to pay for history not for the future..

How can we protect ourselves

We have seen and explained that money creation drives asset prices higher while devaluing savings held in cash over time. With the current record levels of debt across developed countries we would expect this trend to continue. The only way to fund prior debt interest payments and to continue to spend on public goods will require more and more new money to be created.

Once we understand this we must look for ways to save and protect ourselves from currency debasement. Historically living in the west we have been somewhat immune from sharp devaluation, it has been a steady process which has accelerated significantly in the last 5 years. Conversely those who live in developing countries such as Turkey, Argentina and Zimbabwe know too well the impact saving in a devaluing currency has.

Assets such as Stocks, Real estate, Gold and Bitcoin are better placed to protect savers from new money creation. When central banks increase money supply this new money flows first into asset prices.

The prior article on Pensions is a good place to start - long term savings vehicles which are tax efficient. We will continue to discuss other ways to save and invest in future articles using ISAs and savings accounts, however this does require some personal attention and starts with considering if you are doing enough to protect your future finances and protecting the wealth you already have from devaluation.

Remember that what you could buy with £100 in 2010 you now require £169 in 2024 to maintain your purchasing power. If you had saved your money in your bank account since then you would be almost 60% worse off in purchasing power terms.

Islamic perspective:

We have outlined above an economic system which is powered by money creation and interest , where every debt is attached to a rate of interest. This process of creating money from money is intrinsic usury which institutionalises the wealth of people.

We live in a society where it is extremely hard to avoid interest and usury, all of our banks available including Islamic Banks function under the fractional reserve system which we described above relies upon the creation of money from money(riba).

We are not here to suggest that we as Muslims can escape the system entirely, but by understanding how the systems are operating is a key step to leading us to look for solutions and boycotts against the financial system as a way for Muslims to eventually impact how governments think about the economy and money creation.

O you who believe! You shall not consume interest on anything lent, multiplying and compounding the return. Rather, be ever God-fearing, so that you may be successful.” (Surat Aal ‘Imran, 3:130)

Yet beware, for whatever you give others in interest – to gain increase from the wealth of people – shall never increase with Allah! But blessed is whatever you give of the Zakat-Charity – desiring only the Face of God. For it is such as these who shall have a much-multiplied reward.” (Surat Al-Rum, 30:39)

Member discussion