Why is there Unlimited Money for War?

“There is always money for war. You never hear political leaders say they can't go to war because the country can't afford it. They claim not to have money for the poor, homeless and hungry, but war? It's never a problem.”― David Icke

Since the removal of the link between Gold and Money which started during WW1 - governments no longer needed popular support in the form of taxes to raise funding for war.

Read more about What is Money ?

Rather money was borrowed and printed to fund these wars - thus war was still funded by the population but via a loss in purchasing power & inflation rather than direct taxation.

This meant that you no longer needed popular support for your wars. At a time when the UK is looking to fill holes in its Budget and cutting winter fuel allowances, there is a clear black hole of where tax revenue is going...

Some staggering figures:

UK Tax revenue 2023/2024 = £827bn

UK defence spending 23/24 = £54bn

UK interest payments 23/24 = £102bn

Total spending on UK defence and debt = 18.86% of total tax revenue.

A similar and more extreme form of spending on defence and war is seen in the USA - The US accounts for almost 40% of global military spending.

The United States spends a large amount on defence compared to other countries, and its defence spending has increased in recent years: The US spent $820.3 billion on defence in 2023, which was 13.3% of the federal budget. The Department of Defence requested $842 billion for 2024, which is a 2.6% increase from 2023.

WAR is BIG BUSINESS:

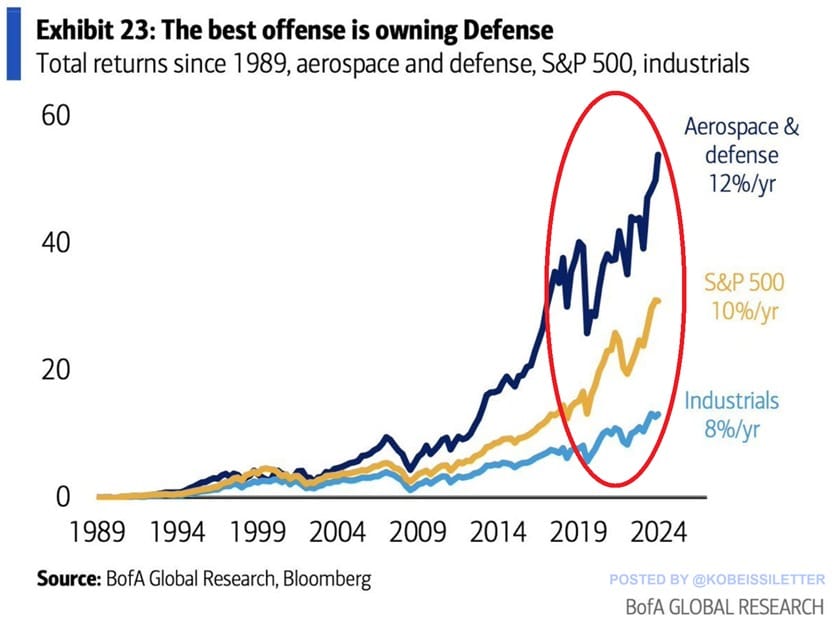

Aerospace & defence stocks have outperformed the S&P 500 index by ~20% per year on average over the last 35 years.

Defence stocks have returned 12% per annum beating the S&P 500's average annual gain of 10%.

Aerospace & defence companies are benefiting from prolonged periods of geopolitical tensions.

Member discussion