What is Money ?

Since we launched the blog we have written on all aspects of Money from printing & inflation to investing and pensions. But we like so many other finance platforms assume that everyone understands what Money Is?

At first the concept of money seems obvious , but have you ever stopped to think what the £5 note in your wallet means and what it represents.

In this short article, we will aim to demystify the thing we are all told to spend a life chasing and earning.

Barter Economies:

Before Money existed societies relied on 'Bartering' to exchange goods. This is when for example you swap apples with your neighbour for his bananas.

However this form of trade significantly hampers economic development and has several key Drawbacks:

Drawbacks of Barter Systems:

1. Lack of double coincidence of wants. - You might not want Bananas when you want to sell Apples

2. Lack of a common measure of value - Apples might be worth more than Bananas

3. Indivisibility of certain goods - How do you swap a Car for bananas? You can't sell 1% of a car.

4. Difficulty in making deferred payments - you might want to sell your apples now but not buy bananas till 6 months time.

5. Difficulty in storing value - If you want to sell Apples and store wealth for a rainy day there is no mechanism to do.

Societies therefore needed MONEY

Money is a medium of exchange - It is a good that is purchased not for its own sake, but for the sake of being exchanged for other goods in the future.

Most economists agree that money must be a medium of exchange, a unit of account, and a store of value:

The Visual Capitalist defines these further:

In other words, money must be:

- Divisible: Can be divided into smaller units of value.

- Fungible: One unit is viewed as interchangeable with another.

- Portable: Individuals can carry money with them and transfer it to others.

- Durable: An item must be able to withstand being used repeatedly.

- Acceptable: Everyone must be able to use the money for transactions.

- Uniform: All versions of the same denomination must have the same purchasing power.

- Limited in Supply: The supply of money in circulation ensures values remain relatively constant.

- Store of Value: You have confidence that your money earnt will maintain purchasing power over time.

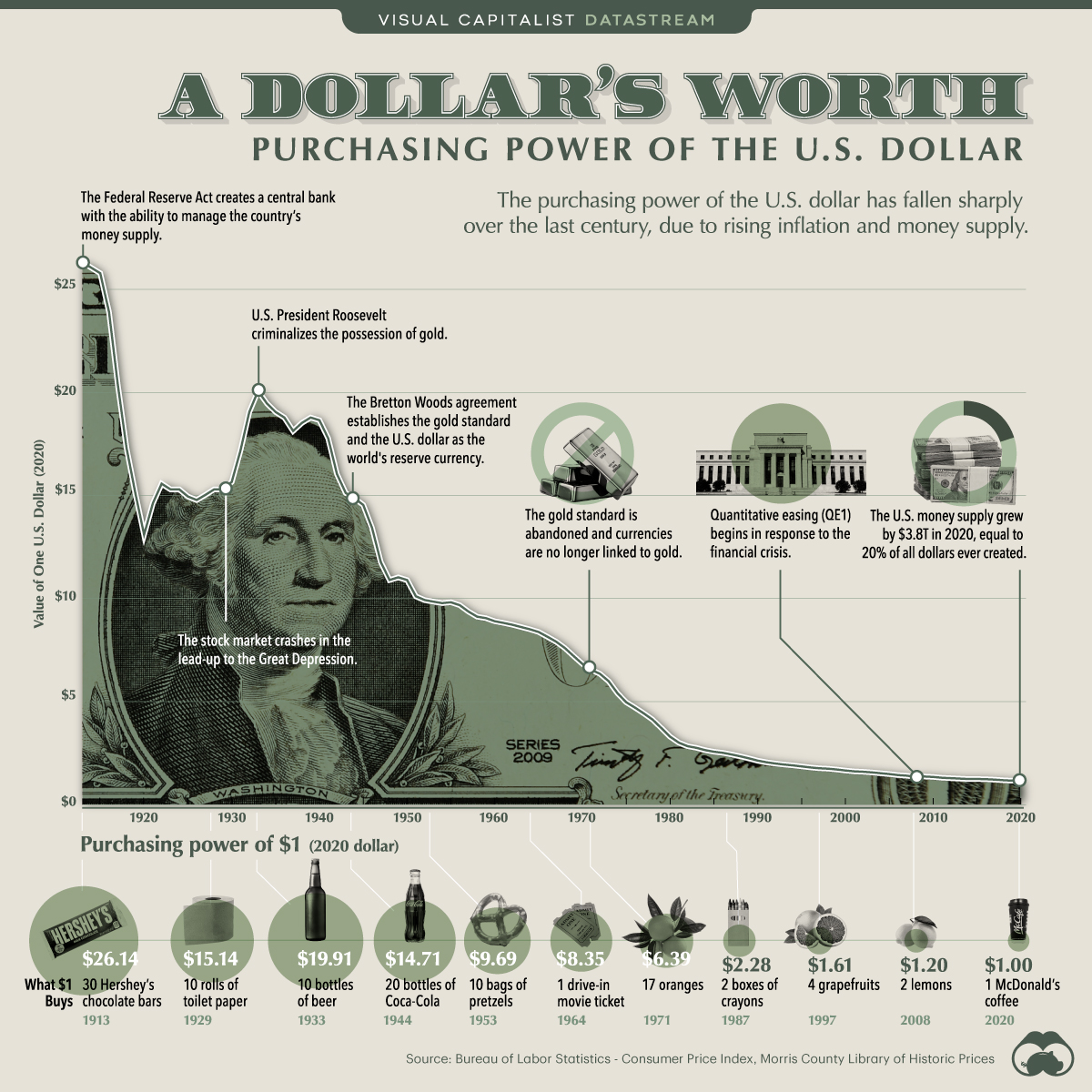

Our current monetary system actually performs very well in points 1-6.

HOWEVER

It has performed particularly badly on points 7 & 8. We have explained in our prior posts how the current monetary system's rapid growth in money supply has driven the economic difficulties of our time. Rapid rises in money supply drive inflation and thus hamper money's ability to store value over time.

Read here about how money supply has risen significantly over the last 30 years: The WORLD is built on debt... what's going on? and Why the money in your bank account doesn’t really exist...

By definition Money should not be "easy" to produce. There is a significant moral hazard by giving a key to the money printer to any individual or organisation and over time this key has been used to transfer money and wealth from the masses to the few.

Here is an infographic from visual capitalist showing how the purchasing power of the Dollar (the world's reserve currency) has dwindled over the last 100 years driven by new money creation. https://www.visualcapitalist.com/purchasing-power-of-the-u-s-dollar-over-time/

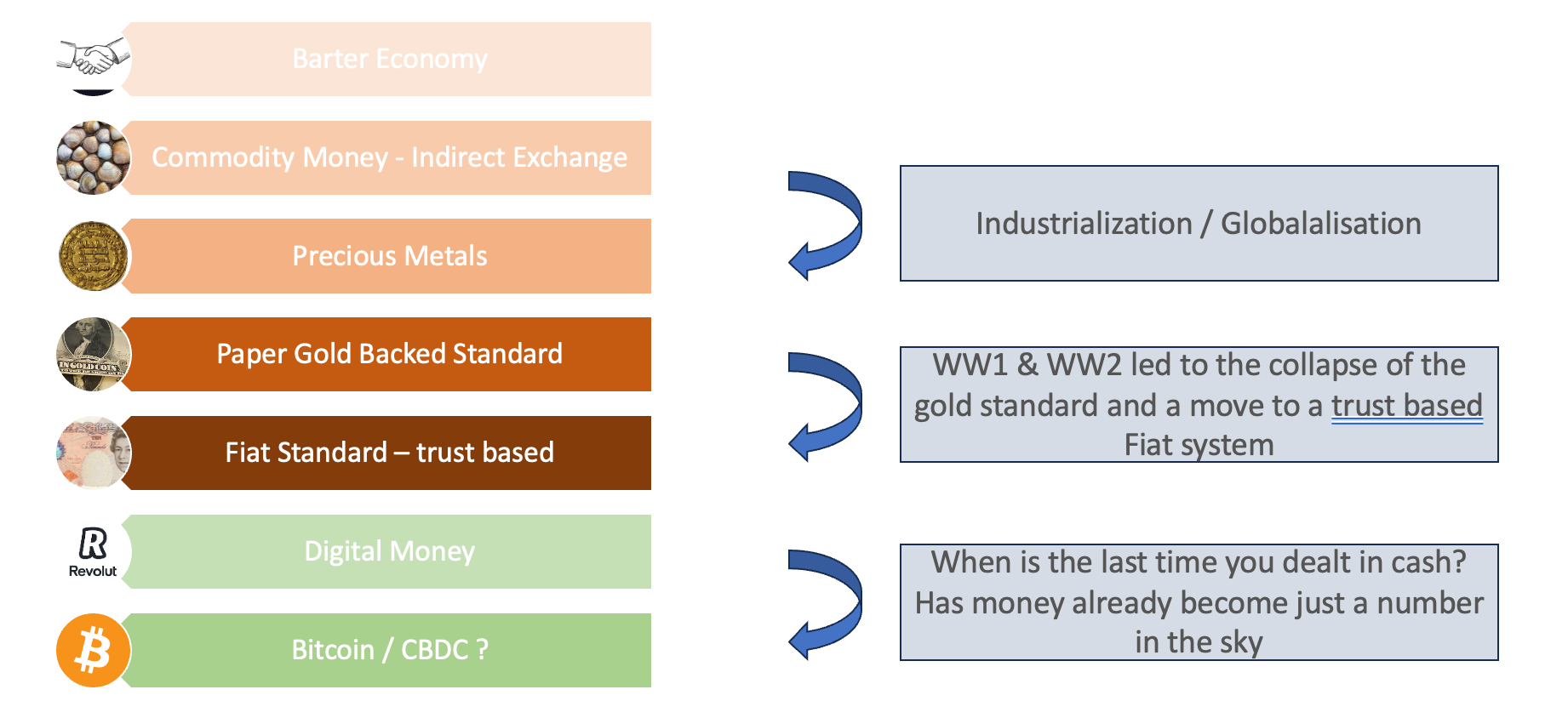

A brief history of money -

The greatest periods of economic growth and improvement in living standards have occurred during periods of Sound money - particularly money which maintains its value over time.

The Italian renaissance was driven by the strong gold coin (the Florin) and the spreading of the Islamic Empire driven by the Gold Dinar.

History also showed us what happened and ultimately drove the collapse of the Roman Empire with the consistent devaluation of their gold coins to fund war. https://www.visualcapitalist.com/currency-and-the-collapse-of-the-roman-empire/

In more modern times initially paper money as we know it was backed 1 for 1 with gold deposits. This lead to massive economic activity and trade as money was easy to move and transact with.

This link between money and Gold slowly began to break - initially to fund WW1 and WW2 and then in 1971 the US Federal reserve broke all ties between money and Gold. Money had become a pure FIAT currency.

Fiat currency is a government-issued currency that is not backed by a commodity like gold or silver. Instead, the value of fiat currency comes from the public's trust in the government or central bank that issues it. The term "fiat" comes from the Latin word for an authoritative order or determination.

The words 'I promise to pay the bearer on demand the sum of five/ten/twenty/fifty pounds' appear on all of our notes.

This money holds value because people in aggregate have faith in the institution that backs it, however as the amount of debt increases in the world does this bring into question the validity of this trust?

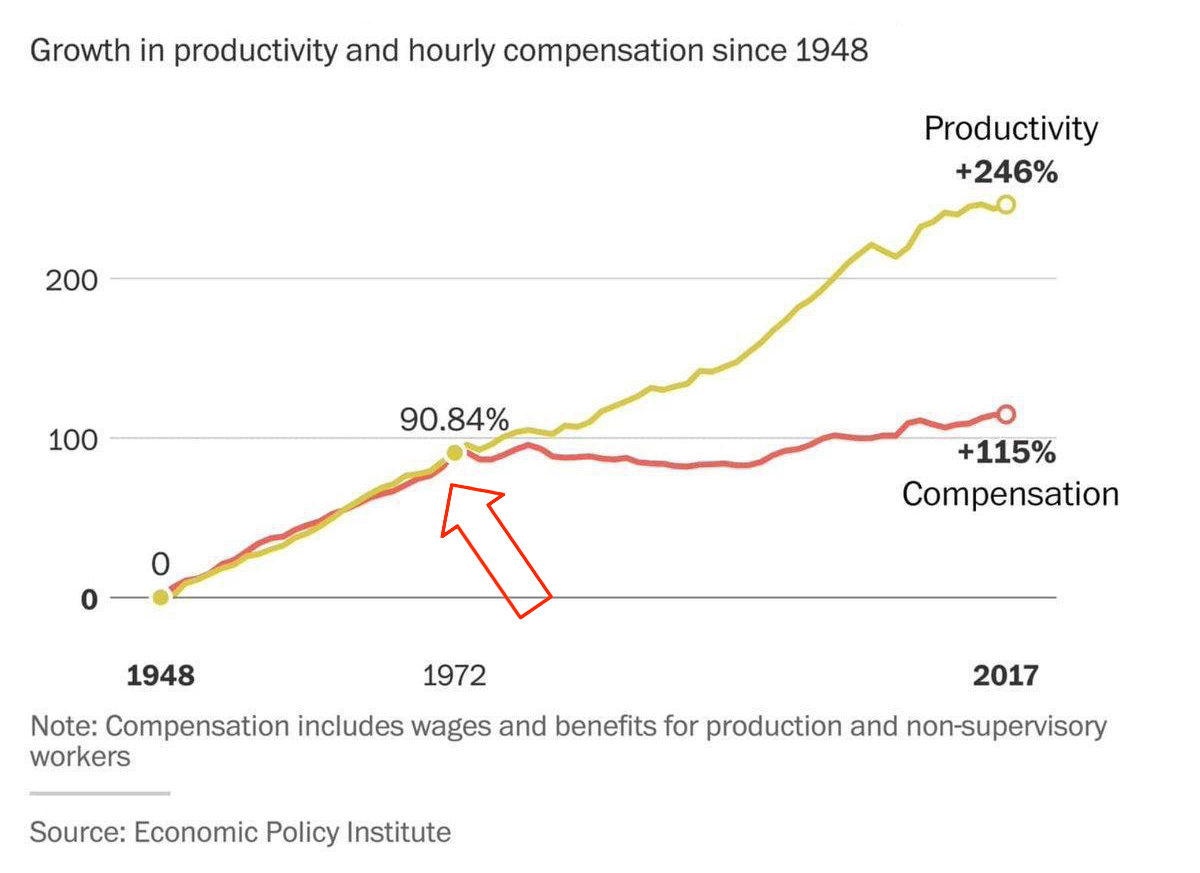

What happened in 1971 - when the link between money and gold was broken we can see below how the gap between productivity and compensation (wages) started to widen - printing money with no backing of a hard currency in this case gold leads to a reduction in living standards for the average citizen.

https://wtfhappenedin1971.com/

Conclusion:

Money is the blood of any economy and it is thus crucial that the money which we use has all the properties of a Sound money which encourages economic growth for all. Under a Sound monetary system economies flourish and generally people have more conviction to save their money as it will hold value over time.

In recent times and particularly since 1971 and then 2008 following the financial crisis, money has become easy to produce and thus value is lost over time. This encourages consumerism and debt based spending rather than investments into long term growth.

When you "fix the money, you can fix the world" is the message by proponents of sound monetary policy. Control of money should not be centralised by anyone - it is comparable to historical times when shells were used as money, technology allowed man to create shells and that is when shells as money collapsed - a similar case can be made for our current monetary system where new money has flooded into the system driving the increasing wealth inequality. New money flows into the hands of those who have assets and thus is truly regressive in nature.

Islam has prohibited Riba the creation of money from money to ensure that we have sound money which can not be manipulated by centralised authorities.

Surah al Imran: Chapter 3, Verse 130

”O believers! Do not consume interest, multiplying it many times over. And be mindful of Allah, so you may prosper.”

Share the article with friends and family: https://share.elevista.ai/ck-cebd-0bab

Member discussion