The WORLD is built on debt... what's going on?

In the last article on inflation, we explained that increases in Money Supply is the biggest contributor to rising price levels in an economy. When there are more pounds in existence everything must rise in price to keep up with the total amount of money .

It is simple supply and demand, when supply of money goes up, the value of that money must fall and thus goods and services get more expensive in nominal terms.

Increases in money supply act as a stealth tax on a population and raise certain concerns that we should start to question:

- When money supply increases your purchasing power is reduced and governments are able to direct the new funds as they please at your expense.

- If a government is able to print new money why then do they need to tax people to fund public spending?

- Do we support the choices made by governments on where this new money is spent. Spending on defence is often funded by new money creation.

- How does a country "print" new money.

Interestingly the majority of people don’t realise that the largest creators of new money are not just the central banks but rather the commercial banks who create money via lending.

In this 2 part article we first discuss the implications of money supply growth on an economy and the population. In the second part we will explain the 2 forms of money creation from central banks via Quantitative Easing and commercial banks via fractional reserve banking.

Money Supply

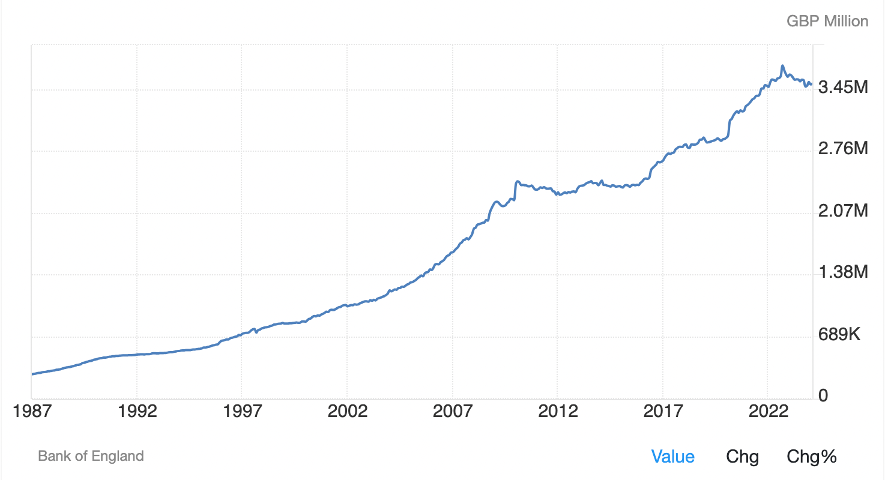

Money supply in the UK as measured by M3 (broad money) has been increasing at a particularly alarming rise since the 2008 financial crisis where the banks were bailed out and the 2020 covid crisis where new money was used in the face of economic slowdown.

Money supply in the UK since 1987:

Over the last 30 years the average growth rate of money supply globally stands at 32% per year with G10 currencies growing at 5-10%.

Increasing money supply is effectively the same as an increase in debt, money that is created must be repaid we can therefore talk about money supply and debt interchangeably.

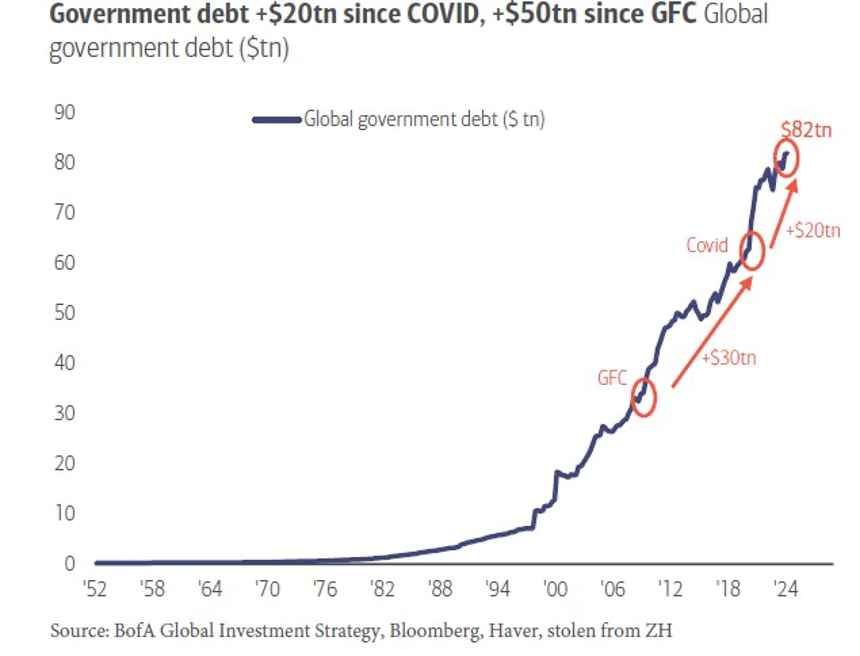

The chart below shows the exponential rise in Global government debt since 2000 driving loss of purchasing power and inflation across the globe while driving asset prices higher.

Countries which have created new money fastest and built up the highest levels of debt have experienced the highest rates of inflation which often lead to hyperinflation. Argentina, Venezuela and Zimbabwe are clear examples of what can happen when money is printed too quickly.

When money is created at such speed, any savings in that currency are destroyed at a rapid pace leading to a destruction of wealth. It is this increase in money supply which has been the major driver of recent inflation. This generally hits the poorest in society hardest who aren’t invested in hard assets which maintain value vs devaluation.

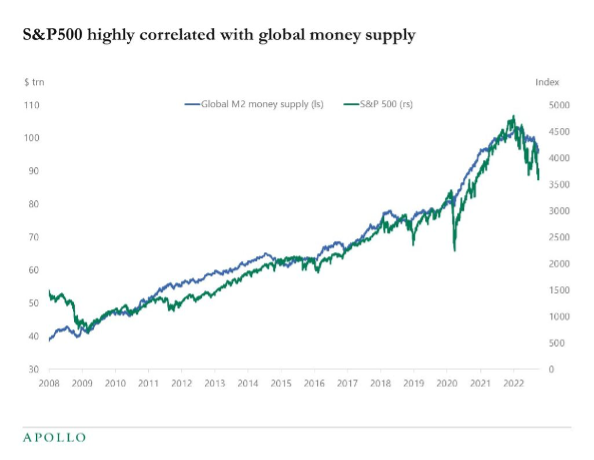

A phenomenon we have talked about consistently in the past articles is that increasing money supply causes the price of assets to rise fastest. This means that stock prices, housing and gold have been able to keep pace with the rise in inflation.

The wealthy who hold assets are able to maintain & increase their wealth in line with money creation, while the poorer in society who spend a larger percentage of their incomes on goods and services and hold fewer / no assets will be significantly worse off. This has driven the rising wealth inequality in our society and made it harder for current generations to achieve financial freedom.

As you can see below the S&P500 which is a broad based index tracking performance of the largest 500 US Stocks is perfectly correlated with the total money supply in the US economy.

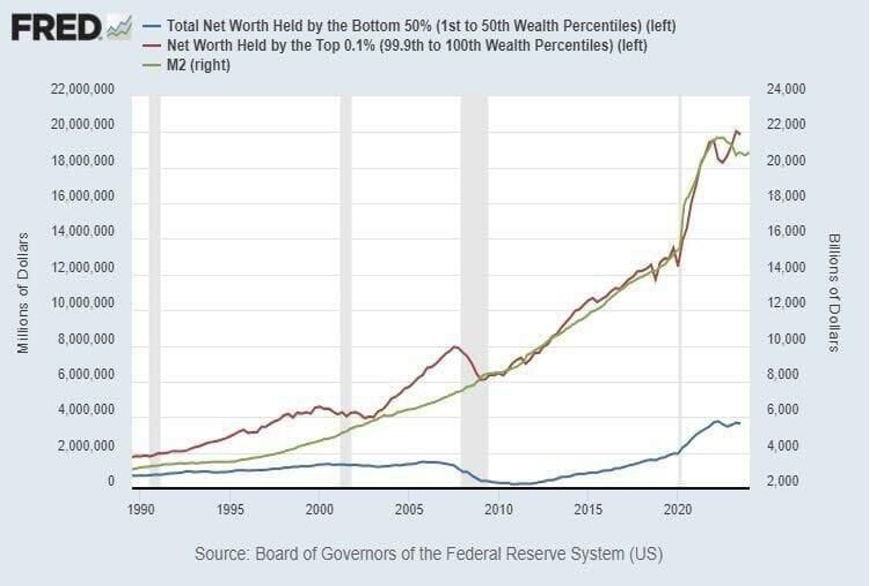

Correlation of money supply(green line) to wealth of the richest(red line) - The new money in creation is flowing directly to the most wealthy, with only very small impacts to the nominal wealth of the majority which doesn't keep up with devaluation.

Debt also devalues nominally with increases in money supply – lets show this in an example, You have a debt of £10 in a £100 economy. Thus your debt is 10% the size of the total economy. Now when the money supply increases to £200 your £10 debt is only 5% of the total economy, your debt has become 50% lower nominally.

- The wealthy are generally capital rich and able to take on large amounts of debt to invest in assets. These assets rise in price faster than the cost of the debt servicing and the nominal value of the debt that they owe devalues as money supply increases in an economy which encourages them to take on more debt and repeat the cycle.

- If you take this one step further, we have explained how Governments are the largest holders of debt , thus it is in their best interest also to continue to print money in order to devalue their prior debt. Thus the process is circular and exponential.

- Meanwhile the less wealthy in society use debt to fund the day to day expenses via credit cards, car finance, pay day loans and companies such as Klarna i,e debt not invested in assets. This debt compounds where the interest cost outpaces the devaluation of the money owed.

This is not an encouragement to take on debt to buy assets! Rather something to consider about who benefits most from money creation.

What happens when you give the government ability to print money at will ?

When a government is given the ability to print money at will there is a creation of significant moral hazard:

- Governments are working towards 4 year election cycles which mean that their choices on spending are driven by re-election. However it is often the case that the most productive investment into a country would be for projects that take 10-20 years

- Under this system would we expect governments to make these hard choices, or rather to increase short term spending on unproductive projects which are politically popular.

Consider whether the UK government spending on Eat out to Help Out had lasting economic impact or merely a politically popular policy at the time?

- The power of money printing sits with these elites and institutions - over the last 100 years since the fall of the gold standard we have seen a world with constant warfare. World War 1 was the start of this where new money was printed to pay soldiers, rather than from tax recipts (which would require the populations support for that war)

This unlimited money supply saw WW1 and WW2 lasting for the longest periods in history whereas prior to this the only way to fund war was to raise taxes on your population. Wars would thus only last as long as the population was happy to support the cause in question.

In more recent times the wars between Russia/Ukraine and between Israel/Gaza have been funded by western governments printing new money which is a stealth tax on the population who are not in support of these causes.

In the follow up article we will go into greater depth on the forms of money creation, and answer the question: 'Does the money in my bank account really exist?'

Member discussion