The Truth About Bitcoin

Bitcoin recently hit the landmark $100k/coin and is finally reaching mainstream financial media with more than 60 Publicly listed companies now holding Bitcoin in their treasuries.

Bitcoin Exchange Traded Funds (ETFs track the price of an asset in this case Bitcoin) have within 1 year a larger Asset Value than Gold ETFs which have existed for almost 10 years.

Trumps arrival in office has brought with it a crypto friendly government. The talks of a Bitcoin strategic reserve which could act to sit as backing for the debt backed currency in a similar way to the vast gold reserves held by the Federal Reserve show the potential role of Bitcoin as a global reserve asset.

This has been a remarkable shift in sentiment after 10 years of negative discourse surrounding this new unknown asset. The majority of people reading this article probably have a similar initial reaction when hearing about Bitcoin, but most lack an understanding of what it really is. This article aims to shed some light on this conversation.

Bitcoin has had many tailwinds supporting its recent price rise but it is its design as a sound monetary system that is shining through and reflecting in its price as more investors and supporters begin to understand what Bitcoin is.

When talking of the Bitcoin price it is important to put the price into some context.

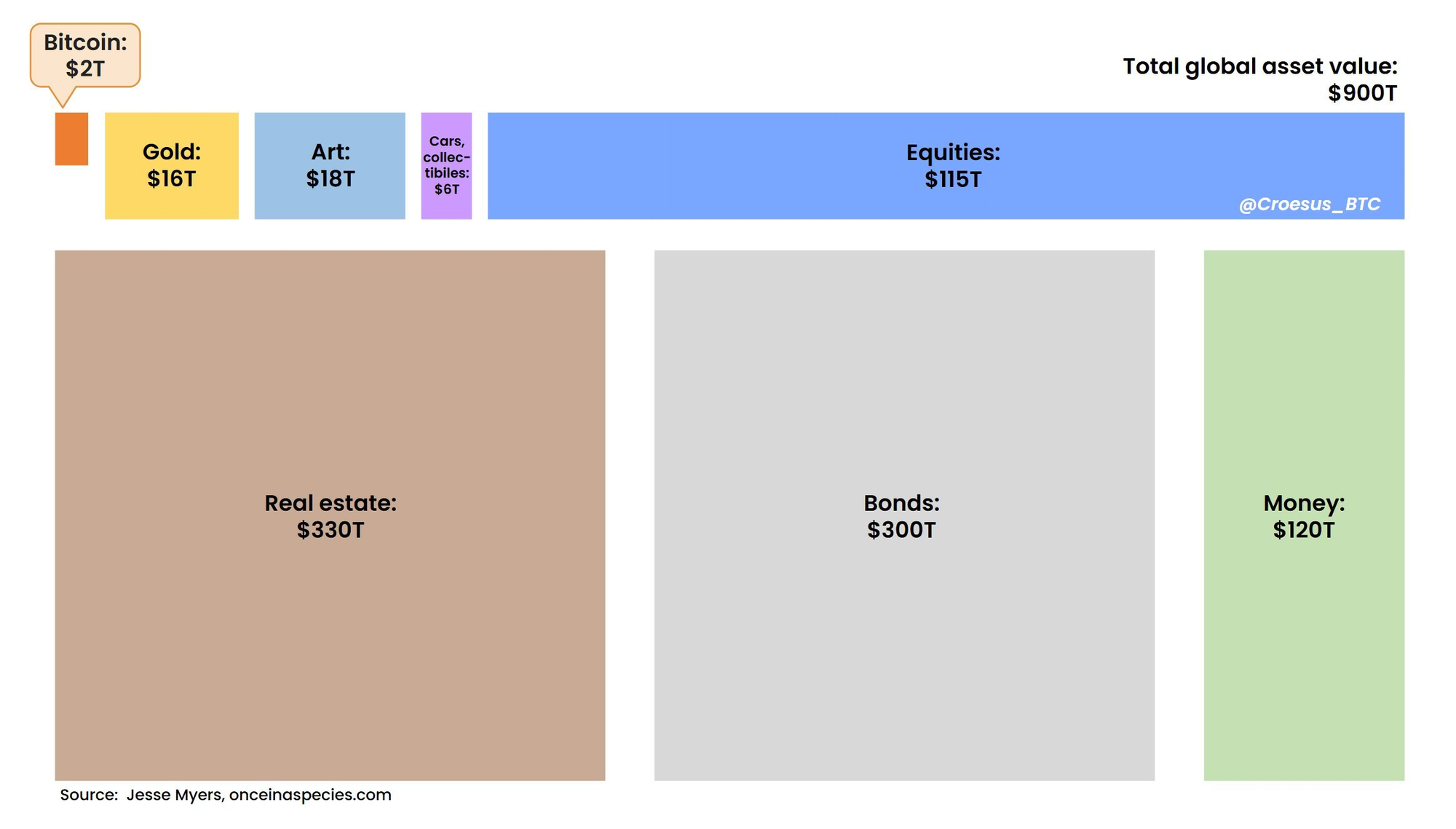

Bitcoins total market cap sits at approximately 2 trillion dollars. When you consider that Apple has a market cap of almost 4 trillion and total Global asset value is 900 trillion, the Bitcoin adoption phase is still in its infancy.

With Fiat money, constant reductions in purchasing power over the last 20 years have negatively impacted the majority whilst rising asset prices have benefited the wealthy thus increasing the greater wealth divide and feeling of a lower standard of living for most. Certainly 'the American dream' no longer is a reality for most. Despite the stock market and Nominal GDP being at all time highs the feeling of prosperity is lacking within the Western world - clearly something has gone wrong.

Read more about What is Money ?

Bitcoin offers an alternative sound money system where there is no centralised governing body and there is a fixed supply of 21 million. This is the first and only true finite asset the world has ever been able to transact and store value in - It is thus crucial for us all to understand what Bitcoin is and not what we think it is.

Below we will start by outlining 3 key features of Bitcoin that will start us on this journey of education. Studying bitcoin can help us understand how modern monetary theory is exploitative and the inherent flaws with our monetary system.

This article is not written with the intention of giving a BUY signal, rather an invitation to start studying Bitoin and its properties. Once a reader has understood the topic, they can themselves decide if it is an investment that they would like to make.

3 Key properties of Bitcoin:

1 - Fixed Supply

2- Decentralised

3- Self sovereignty of money

1 - Fixed Supply

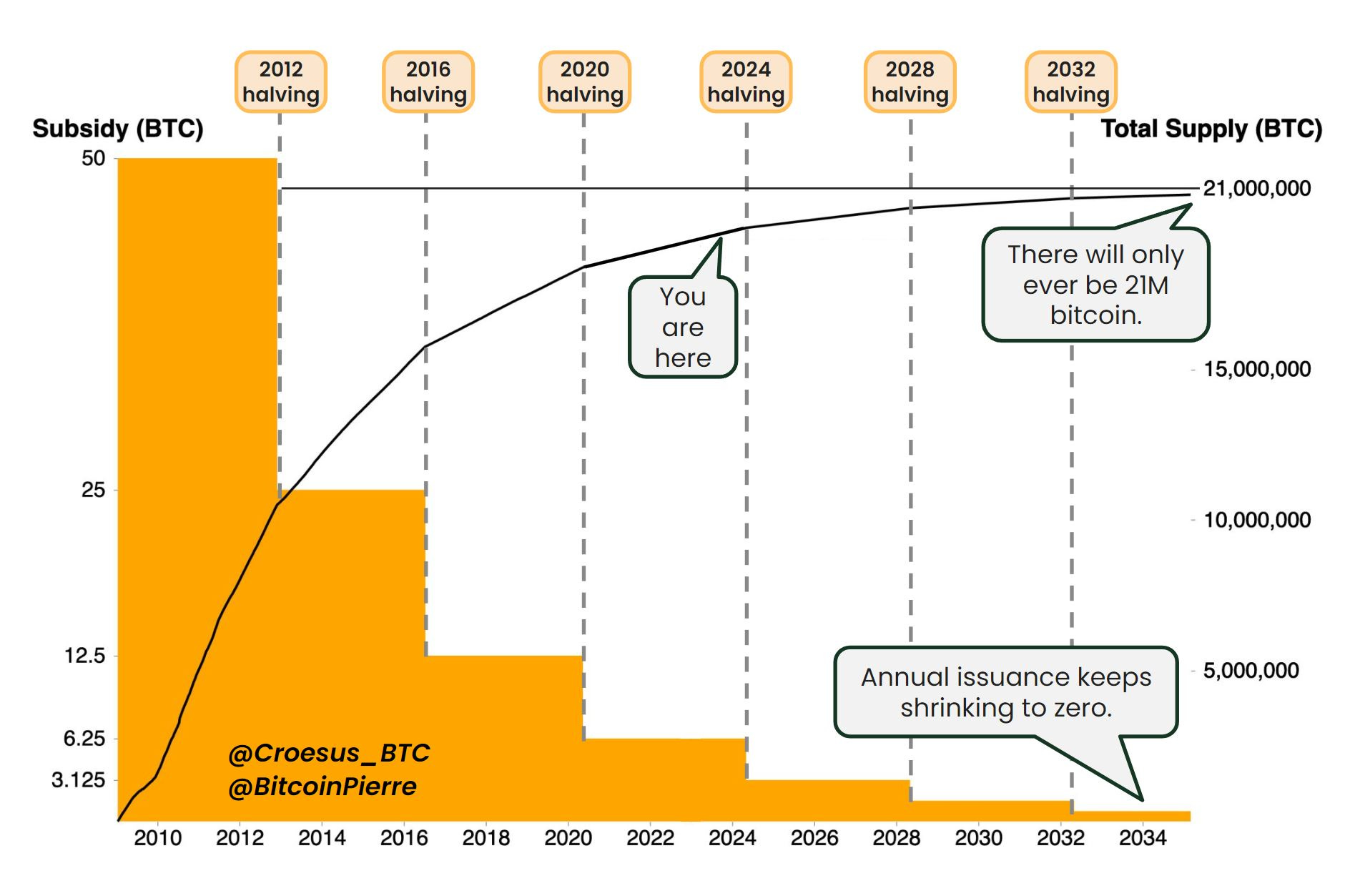

Bitcoin is mathematically programmed to have a fixed total supply of 21 million coins. That means that unlike fiat money no government or institution can devalue currency via debt creation and stealth tax its population to pay for its spending desires.

There are approximately 20 million Bitcoin in circulation as of 2024. Once the number of bitcoin in circulation reaches the 21 million supply limit, the protocol will no longer issue new Bitcoin. The circulating supply of Bitcoin is expected to reach the max supply limit of 21 million coins near the year 2140. At each 4 year "halving" the number of bitcoin awarded to miners is halved thus the rate of issuance of Bitcoins slows over time tending towards 0.

Given that 95% of the coins already exist the rate of monetary inflation now is extremely low and tending towards zero.

Having a fixed total supply means that in a bitcoin world there would be no monetary inflation, thus purchasing power should not decrease but rather increase over time. Technology in the long term drives prices down as society learns new skills.

In a world of excess and abundance, Bitcoin (BTC) stands as one of the few truly scarce assets.

Politicans have already told us what happens when Governments spend beyond their means. The cost of that debt will always paid by the working classes and not the wealthy in society. Here is Alan Greenspan former head of the Federal reserve

2- Decentralised

Decentralization is one of the key features of Bitcoin that sets it apart from traditional banking systems. Understanding what decentralization means in the context of Bitcoin is essential to appreciate its significance and potential impact.

Decentralization means that no single entity has control over Bitcoin; rather, it is a network of computers that work together to maintain the system. This network of computers, also known as nodes, are distributed all over the world, making it difficult for any one entity to manipulate or control Bitcoin.

Another important aspect of decentralization in Bitcoin is the fact that anyone can participate in the network. All you need is a computer and an internet connection to become a node within the network. This means that bitcoin is truly a peer-to-peer system, with no central authority or intermediaries.

3- Self Sovereignty

Given the decentralised design of Bitcoin mentioned above, Bitcoin allows owners to have full self sovereignty of their assets.

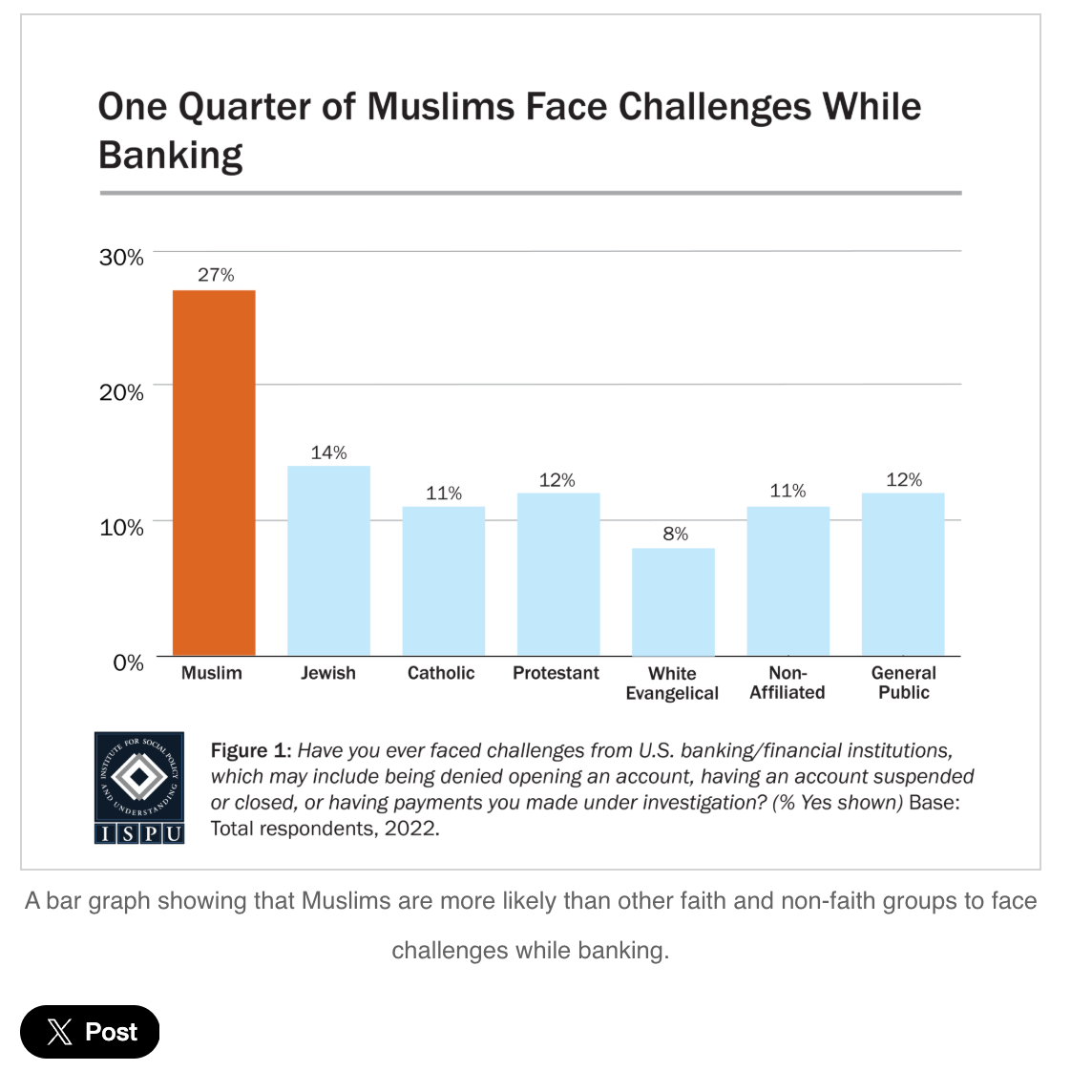

With Fiat money, there is trust at every stage from the govt/central bank controlled supply of the currency to the financial institutions that have strict rules on how you can spend and access your funds. This was clear with the trending hashtag #BankingWhileMuslim.

Our banking system is built on fractional reserve banking, this means that only 10% of your bank deposits must be held by the bank, the 90% can be lent out to others which both inflates the money supply but also means that if all depositors were to withdraw their funds the bank would be left empty and unable to repay their obligations.

With Bitcoin, owners can choose to take control of their coins into their own custody. This means that the funds are always secure in your possession with no external institutions able to tell you how you may use or spend your coins.

We can see the importance of this feature by analysing the current situation in Gaza - it has been notoriously difficult to send Fiat money as charity directly into Gaza over the last 12 months. The Bitcoin For Palestine movement has enabled bitcoin users to send funds directly into Gaza to Yussef Mahmoud who has been documenting how these funds have been used to provide food and welfare for those most in need. https://x.com/btcpalestine , https://x.com/Yusef_Mahmoud1

Read more about Bitcoin Self Sovereignty: https://www.rhinobitcoin.com/blog/why-bitcoin-is-the-key-to-financial-self-sovereignty

Conclusion:

Over the coming months at Rizq Revolution we will cover more of Bitcoins' key features in an attempt to debunk some of the misconceptions surrounding the asset. While we clearly write from a perspective in favour of bitcoin we encourage readers and investors to first Study Bitcoin and understand how it works before investing.

Bitcoin prices will remain highly correlated with adoption of the technology - with approx 2% of people owning some it appears there is further room for growth.

When we speak of Bitcoin we refer only to Bitcoin not the wider cryptocurrency space. Bitcoin has become well established as the largest cryptocurrency, with features that make it unique amongst the crowd of competing coins who's ethos differs drastically from core Bitcoin values of a purely peer to peer decentralised payments system.

If you made it this far ... congratulations! BUT the journey to study Bitcoin doesn't end here. Linking below 2 key Resources to continue your education ..

1- The Bitcoin Standard by Saifedean Ammous

Widely regarded as the number one Bitcoin book - explaining from first principles the key concepts around money and how money aught to work.

https://www.amazon.co.uk/Bitcoin-Standard-Decentralized-Alternative-Central/dp/1119473861

“[This] should be required reading for everyone in modern society,” writes Michael Saylor, CEO of MicroStrategy, in his foreword to the latest version of The Bitcoin Standard (subtitled, the decentralized alternative to central banking) by Saifedean Ammous.

Saylor suggests that “It was this book, more than any other, that provided the holistic economic framework that I needed to interpret the macroeconomic forces reshaping our world.”

2- God Bless Bitcoin documentary

1,027,438 views - Premiered Jul 25, 2024

God Bless Bitcoin asks the timely question: How do we fix our broken money? Through in-depth conversations with bitcoin and interfaith religious leaders, the film exposes the broken, unjust, and immoral nature of our current fiat-based monetary system, one that is intimately connected to the military industrial complex and the propagation of war.

The film also shows how and why members of the poor and middle class feel a financial squeeze even when they work hard and lead fiscally responsible lives. God Bless Bitcoin ultimately suggests the ways in which Bitcoin can present alternatives to our current system that are more just, equitable, and peaceful.

Member discussion