The Case for Low Time Preference in a Fiat World

In a world obsessed with “buy now, pay later,” the art of patience is almost extinct. Fast food. Flash sales. Same-day delivery. We’re taught to crave now — and avoid anything that demands waiting.

But what if waiting is where real value lies?

In Chapter 5 of The Bitcoin Standard, Dr. Saifedean Ammous introduces a concept that reshapes our understanding of choices: time preference. At its core, time preference is about how much you value the present versus the future.

And in this age of consumerism, instant gratification, and fiat money — it’s a lesson we desperately need to relearn.

The Fisherman and the Long View

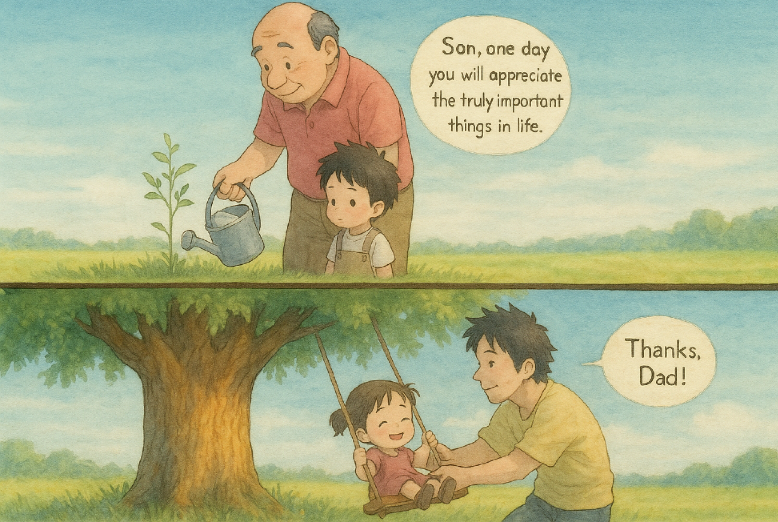

Ammous shares the story of a fisherman who catches just enough each day to feed his family. One day, he works a bit longer and catches more fish than he needs. Instead of consuming the surplus, he saves and trades them for a better net. Over time, he builds a thriving operation, employing others and creating a sustainable future.

This simple parable illustrates the power of low time preference — delaying comfort now to invest in something bigger later. It’s how civilizations are built. It’s how wealth is created. It’s how values are passed down.

But something changed after 1971.

Fiat, Inflation, and the Rise of High Time Preference

In 1971, the U.S. severed the link between the dollar and gold, abandoning the gold standard and unleashing an era of fiat currency — money backed by nothing but government decree.

The result?

Central banks could print unlimited money. Inflation became the norm. And the value of savings — of thinking long-term — began to erode.

Why save if your money buys less each year? Why invest when speculation promises quicker returns? Fiat money systems reward short-term thinking and encourage consumption. They train societies to value the present more than the future, to spend rather than save, to borrow rather than build.

We’ve become like the fisherman who eats all his catch every day, never thinking about tomorrow. Ironically, it is through saving, investing, and holding wealth in sound money that we are protected from inflation and protect our futures.

Saving, investing, and budgeting are practical tools that strengthen the habit of delayed gratification. By consciously setting aside wealth, allocating it toward long-term goals, and resisting impulsive spending, we train ourselves to value the future over fleeting desires.

Bitcoin: A Technology for Patience

Enter Bitcoin.

With a capped supply of 21 million coins, no central authority, and an issuance schedule that mimics gold’s scarcity, Bitcoin offers something radical: money that rewards long-term thinking.

Bitcoiners don’t just invest — they hodl. They save. They delay. They think in years, not days.

This isn’t just a financial strategy — it’s a philosophical shift. Bitcoin lowers your time preference. It rewires your mindset toward building, learning, growing, and giving — because you believe the future holds more value than the fleeting now.

History shows us the power of sound money, encouraging low time preference - The Italian Renaissance was a product of low time preference — generations of patrons, scholars, and artists invested in education, preservation, and beauty without expecting immediate returns. This cultural flourishing was underpinned by the Florentine florin, a stable, gold-backed currency that preserved value over time and encouraged saving, investment, and long-term thinking.

In essence, Bitcoin (sound money) nudges us closer to a mindset already embedded in another powerful framework: Islam.

Islam: A Faith of Delayed Gratification

Islam, at its heart, teaches believers to think beyond this life. The hereafter (akhirah) is central. Every act of worship, every sacrifice, every struggle — is a choice to prioritise eternal reward over temporary ease.

Fasting

When we fast during Ramadan, we willingly give up food and comfort. We’re not chasing calories — we’re chasing consciousness (taqwa). Fasting is a literal exercise in delayed gratification, teaching us restraint and patience for something far more valuable than a meal: nearness to Allah.

Prayer (Salah)

Five times a day, Muslims pause their worldly engagements to connect with the Divine. There’s no material return. Yet we show up. Consistently. Why? Because we believe in the unseen, in the unseen reward, in the long game.

Charity (Zakat & Sadaqah)

Giving from your wealth to support others, especially when it's hard, is an act of low time preference. You give now, trusting in reward later. You let go of what you love for the sake of something greater.

This mindset is deeply countercultural. In a society where wealth is flaunted, indulgence is celebrated, and the future is ignored — Islam trains the believer to sacrifice the now for the eternal.

The Ultimate Stand for the Future

No example captures this better than Hussain bin Ali the grandson of the Holy Prophet at Karbala.

Offered safety and power in return for his silence and allegiance, Hussain chose a harder path — the path of truth, integrity, and sacrifice. He knew the cost. Yet he chose the akhira (hereafter) over the dunya (worldly pleasures) , the permanent over the perishable.

It was the most powerful act of low time preference in Islamic history — and it echoes to this day.

https://whoishussain.org/who-is-hussain/the-full-story/

The Way Forward

Whether you’re a Bitcoin believer, a practising Muslim, or someone seeking meaning in a noisy world — the message is clear:

The future matters.

Build it. Invest in it. Pray for it. Fast for it. Give for it. And if needed, sacrifice for it.

Because the ease of now is fleeting — but the reward of waiting is eternal.

Extra resources :

The Bitcoin Standard pdf : https://cryptache.ro/wp-content/uploads/2021/04/The-Bitcoin-Standard-The-Decentralized-Alternative-to-Central-Banking-PDF-Room.pdf

Member discussion