Step 1 : Clear your expensive debt

LOANS are available everywhere! In the consumerist society that we live, loans are available for almost all purchases including mortgages, credit cards, car finance, payday loans, whilst companies like Klarna have been created to encourage debt to purchase everyday items such as clothing. As a result, we have seen a rise in household debt levels across all social levels as a reliance on debt to fund lifestyles increasingly becomes the norm.

Step 1 on our journey to financial independence thus has to start with clearing our expensive debt.

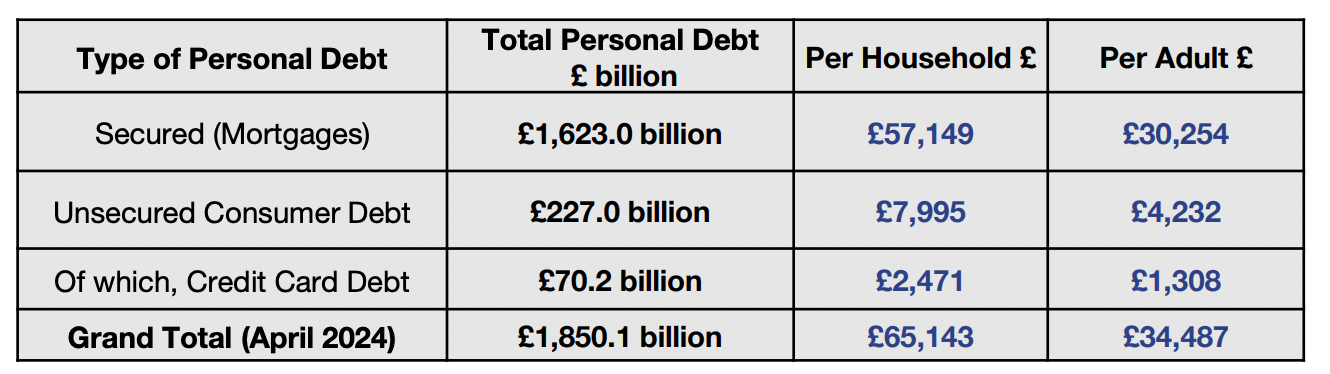

Total household debt in the UK now exceeds £1.8 trillion for the very first time - the equivalent to £71,000 per household , and is just below national GDP (£2.2 trillion). Excluding mortgage debt average debt per household stands just under £8k.

Based on April 2024 numbers, The average annual interest per household over a 12-month period would have been £2,710 and per person £1,435, 4.03% of average earnings. (data from the https://themoneycharity.org.uk/ )

Impact of debt on us:

- Nearly 75% of indebted individuals said they thought about their financial burden more than they wanted to.

- 97% of people with debt believe they'd be happier if they were out of debt

- Mortgage debt was the only form of debt which did not impact our emotional welfare (more on this to follow)

The Key to building wealth and improving our financial future starts with managing and clearing our outstanding debts. Consumer debt is expensive and often one ends up repaying multiples of what they originally borrowed due to high interest costs. This comes at a massive opportunity cost to your savings and investment goals and therefore all financial planning must initially start with clearing debt.

By the end of this short article we hope you will understand why clearing expensive debt has to be step 1 on our path to financial freedom. Being debt free clears the path for the saving and investments to begin and compound in our favour. (we talked about this in our article Compound growth - The 8th wonder of the world)

Not all debt is created equal

Not all debt is created equal, and certain loans (generally unsecured) can lead to a much heavier financial burden than others.

The average annual percentage credit card rate stands at 35% and personal loan and car finance rates at around 8-12% at the moment.

The rate you are paying on your expensive borrowing will almost always be higher than the savings / investment gains you can make. Furthermore where debt is used for consumption goods the impact is felt even greater with the opportunity cost of funds that aren't saved or invested for future financial independence.

The golden rule with debt repayment is to pay off your most expensive debts first. These are usually, in order of interest rate levels:

- Overdrafts & Payday loans

- Credit cards

- Store cards / Klarna

- Personal loans

Even if there is flexibility around how much you repay each month – for example the minimum repayment with credit cards – that doesn’t mean you should use it! The longer you take to repay these debts, the more they cost you overall.

Before you start clearing your most expensive debts, it’s important to understand your monthly expenses and where and how you're going to save money to begin repaying your debt. Writing budgets and analysing your spending trends can help you manage your income.

Debt consolidation:

Consolidation is the process of taking out a new loan or line of credit and using it to pay off multiple debts. Consolidation doesn’t reduce the amount you owe, but it restructures it.

People generally consolidate debt for two reasons. First, debt consolidation can make handling your budget easier. Instead of juggling multiple monthly credit card bills, you’ll only have your consolidation loan to pay.

Consolidating might also save you interest if you’ve improved your credit score since taking on your original debt.

To give an example of this, you have a store card loan and 2 credit card bills outstanding all of which have high interest rates. You may depending on your credit score be eligible for a personal bank loan to cover the outstanding balnces on this debt. This would allow you to have cleared your expensive debt at a cheaper rate and have one more manageable repayment which can be an easier goal to focus on to repay.

There are of course always a few exceptions to when keeping debt can make sense.

Mortgages:

Experts often view mortgages in their own category - their use has become a necessity in the modern era in order to achieve home ownership.

Mortgages are a form of asset backed loan, where the property in question is held as collateral in the case of a default. Mortgage rates are thus generally the lowest interest rate loans on offer and can assist in wealth creation. As we discussed in prior articles on inflation and debt: Real estate and property prices have risen over time driven by new money printing.

SO while we acknowledge that house prices are high and unaffordable for many they can be even said to be a positive step in the path of wealth creation. The money spent on repayments are at least slowly building ownership in the property while money spent on rents are seen as just an expense.

Other circumstances:

0 % credit: If, for example you have interest-free borrowing via a credit card for a set term and so long as you have the money to clear the debt before interest charges kick in there is some merit in using the free debt for purchases e.g a fridge to repay over a set amount of time with no extra costs. This will also help to improve your credit score which will become useful when applying for mortgages.

Student loans are deducted based on your earnings with a set calculation. Thus while they can be expensive it can often be argued that they are a capital expense and can be paid off over time as your earnings increase. Some further details on student loans can be found here.

Credit Scores:

Credit scores are tracked by lending institutions and they determine your likelihood of repaying your debt. They will determine your acceptance for loans and also the rates on offer. They are especially important to mortgage applications.

It is essential to make sure we build our credit rating higher from a young age and keep it high. This can be done via prudent financial behaviour - repaying of credit cards in full every month, not going into overdraft often, not taking our multiple credit cards which are covered with just the minimum payment.

For more details on Credit scores: https://www.lloydsbank.com/understanding-credit/what-is-a-credit-score-how-does-a-credit-score-work.html

Islamic Perspective

Writing articles about debt is uncomfortable when writing from a Muslim perspective - is debt halal? in what circumstances can i take on debt? can i earn interest ? And we have all become reliant on debt in some form, comfortable speaking about interest with no second thought driven by our societal norms.

I think we know deep down as Muslims that the concept of debt has become overlooked and ignored by our communities. Interest particulalry between muslims is considered a sin and while we have made exceptions in this society for home ownership and business loans - we have as a community become overly reliant and users of the credit on offer to us.

The less we can become reliant on debt the better position we will be in for our futures. Lowering our consumption & wants is a reminder of the temporality of this life and our true purpose. Allah (swt) reminds us of this beautifully in Surah Baqarah:

أُو۟لَـٰٓئِكَ ٱلَّذِينَ ٱشْتَرَوُا۟ ٱلْحَيَوٰةَ ٱلدُّنْيَا بِٱلْـَٔاخِرَةِ ۖ فَلَا يُخَفَّفُ عَنْهُمُ ٱلْعَذَابُ وَلَا هُمْ يُنصَرُونَ

2:86 Those are the ones who have bought the life of this world [in exchange] for the Hereafter, so the punishment will not be lightened for them, nor will they be aided.

Disclaimers:

The contents of this presentation should not be considered to be legal, tax, investment or other advice, and any investor or prospective investor considering the purchase or disposal of any investment should consult with its own counsel and advisers as to all legal, tax, regulatory, financial and related matters concerning an investment in or a disposal of such investment and as to their suitability for such investor or prospective investor.

For further information please talk to an authorised and regulated independent financial advisor.

Member discussion