Compound growth - The 8th wonder of the world

Often the thought of building significant savings and wealth is daunting when starting from 0, however the key to wealth creation lies with compounding, time in the market and a plan.

The earlier we start investing the greater the compounding effect. Time matters more than size and even what may seem like the smallest sacrifices can grow into meaningful amounts over time.

Financial compounding will be the recurring theme found in every investment textbook and for good reason...It is how Warren Buffet has accumulated his wealth and infamy as the worlds greatest investor.

Warren Buffet’s wealth at different ages

Financial Compounding:

Financial compounding is the process by which an investment’s returns, from capital gains or income or both, are reinvested to generate additional returns over time.

It’s like a snowball being rolled down a hill: it starts off small with not much extra snow added, but the bigger it gets the more snow it gathers. The further the snowball goes the more powerful the effect, which is why time plays such a big factor in compounding. The effect is unimpressive at first but can turn into something spectacular as the years progress.

This is best shown in an example:

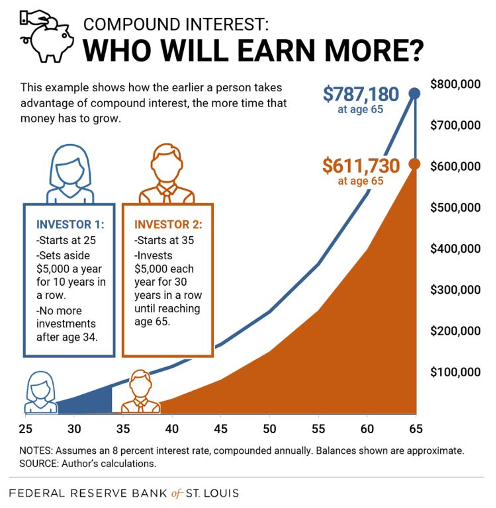

Time spent in the market benefiting from compounding is the key driver to wealth growth.

Investor 1 invests $5k a year from 25-35 and then stops investing. Investor 2 starts at 35 and invests $5k a year for the next 30 years.

Amazingly Investor 1 ends up with over $160k more at the time of retirement in this case at 65. This is assuming 8% growth rate per year in assets which is the approximate return of the US Stock market in recent history.

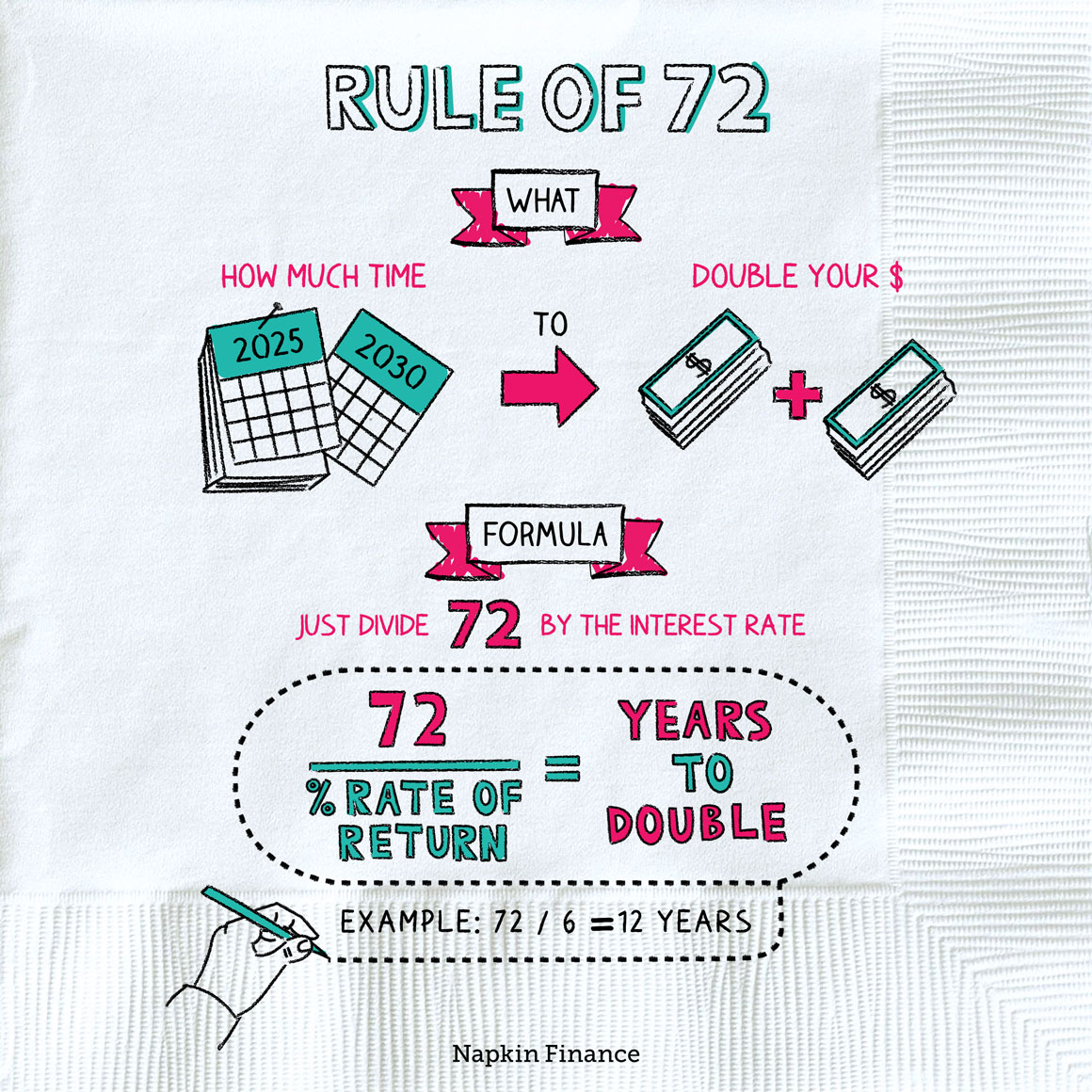

The key factors at play when determining compound growth is the time in market and rate of return. We can easily think about wealth creation in the context of doubling our investment and the rule of 72.

The rule of 72:

The rule of 72 allows us to easily calculate how long it will take to double our investment amount given a rate of return.

By dividing the yearly return of an asset by 72, gives us the number of years it will take to double our money.

At a 7% growth rate we would double our money in approximately 10 years. At 10% growth rate we would double our money in approximately 7 years.

Thus the earlier we begin investing the more time we allow ourselves in the market for "doubling" our money. Short term sacrifices lead to large long term gains.

Einstein on compounding:

"Compound interest (growth) is the eighth wonder of the world. He who understands it, earns it. He who doesn't, pays it,"

It is critical to understand how compounding can adversely impact us. Debt requires us to pay a rate of interest for the loan - if we use this debt to buy assets which are not growing faster than the cost for example a car loan then the overall cost of debt is compounded against you.

Borrowing £20k as a car loan for example over 5 years with an interest rate of 10% would cost you £25k over the 5 years.

Conclusion:

Money not invested and benefiting from growth - for example savings kept in a current account with low rates of interest will have a significant opportunity cost.

Asset prices historically rise over time driven by the impact of monetary devaluation and money printing we discussed in The WORLD is built on debt... what's going on?

The more we can save and invest the earlier in life the greater impact compounding will have on our wealth growth over time. This is crucial in enabling us to achieve our financial goals and financial freedom. We have explained in prior articles why investing in assets which grow in value is so important to protect ourselves from devaluation and inflation. Now we must let compounding work its magic and help us on the journey towards financial freedom.

Investing requires patience & sacrifices to current consumption(delayed gratification) for a better future. Let compounding work in your favour with investments and not against you with debt.

Pensions are a great place for us to begin this compounding journey - they benefit from instant tax benefits up to 40% and are LONG term investments preparing our financial freedom through retirement. Read more in our pensions post: A Guide To Pensions

In the Quran Allah beautifully talks about the compounding returns for our acts of charity. In our plan to grow our wealth and move closer to financial freedom, charity and giving back to others will be a key driver to our success.

"The likeness of those who expend their wealth in the way of God is as the likeness of a grain of corn that sprouts seven ears, in every ear a hundred grains. So God multiplies unto whom He will; God is All-embracing, All-knowing." (2:261)

Member discussion