A Guide To Pensions

❗ Did YOU know to have a yearly income of £28.5k/year your private pension pot needs to be £600k. 😳

This might seem unattainable & Retirement age 👴🏽 👵🏽 may feel like a long way away but this is not the time to despair. The EARLIER we can start planning our futures the better chance we have of being financially free. Pensions are the most tax efficient ways of saving and with the power of compounding and time on our side building a sizeable pension pot to support us in our older age is a realistic goal. 📈

The maximum State Pension is a lot less than the amount most people say they hope to retire on.

For 2024/25, it’s £221.20 a week – or £11,502 a year.

- It’s important not to rely on the State Pension to keep you going in retirement.

- Even if you’re eligible for the full State Pension of £221.20 a week for the tax year 2024/25,this is far below what most people say they hope to retire on.

How much DO I need in my Pot when I retire?

Compound growth (The 8th wonder of the world!)

Private / Workplace Pension schemes

How can I make my Pension Halal (Shariah compliant)

YOU can request to amend your allocations

How much DO I need in my Pot?

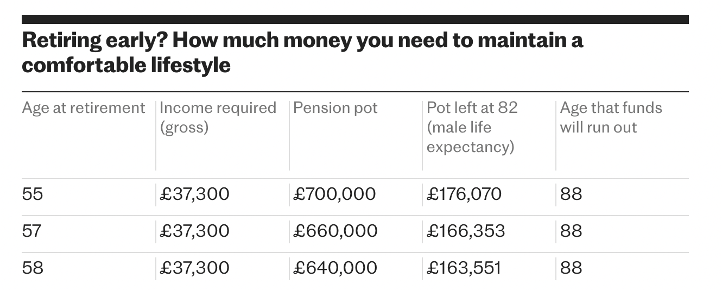

In order to maintain your lifestyle and be self-sufficient you will need to have a large pot to provide for a time when you have no income beyond your savings:

- It’s impossible to forecast how long your retirement will be, but it’s good to be optimistic and assume it will last at least 30 years (on the basis that your retirement age will be around 65).

- Of course we are all seeking to achieve financial freedom earlier in life to enable us to focus on other interests and serve our communities – this requires pre planning and commitment to longer term investments at the expense of our short term consumption – The years of highest earnings are the years where you should be investing the most.

- At current purchasing power the below tables illustrate how big your retirement pot needs to be to achieve various income levels

With inflation continuing on its current trajectory we are likely to need much more than that at retirement.

|

Size of Pension Pot |

Pension Annual Income |

Annual Income including State

Pension |

Interest free lump sum taken

at 55 |

|

£100,000 |

£4,911 |

£16,411 |

£25,000 |

|

£200,000 |

£9,849 |

£21,349 |

£50,000 |

|

£300,000 |

£14,658 |

£26,158 |

£75,000 |

|

£400,000 |

£19,189 |

£30,689 |

£100,000 |

|

£500,000 |

£23,720 |

£35,220 |

£125,000 |

|

£600,000 |

£28,251 |

£39,751 |

£150,000 |

Source: Aviva, Assumption that you take 25% of your fund as a tax-free lump sum before your annuity – this can be reduced to increase your annual income above. (Your income is fixed – paid monthly to you)

What if you want to retire earlier than 65?

The Money Helper pension calculator is a great place to start when thinking about how much you should save into your pension. It:

- Works out how much someone on your salary might want to retire on

- Calculates how much you’re paying and how much you’ve saved.

- Considers how much state pension you’ll receive.

- Identifies any shortfall between the income you want and what you’ll get

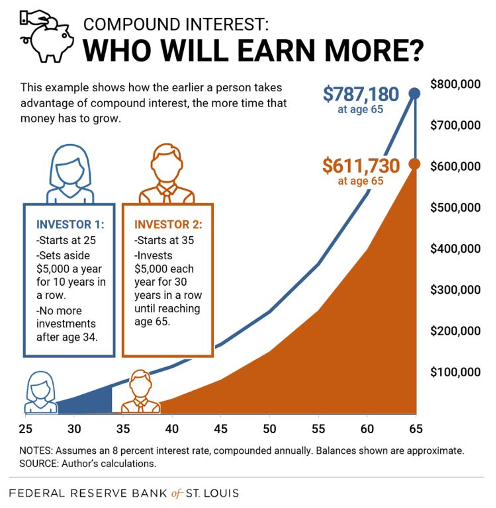

Compound growth (The 8th wonder of the world!)

Building a pot of £500k+ sounds daunting, but with compound growth the earlier and more you're able to set aside the faster you will be able to achieve that goal.

With compounding a 7% annual growth rate in your investments will almost double your initial investment. The MSCI world index which tracks the performance of the world's largest companies has had a growth rate of 11% annually over the last 10 years. (Past performance is no guarantee of future results)

Time spent in the market benefiting from compounding is the key driver.

Investor 1 invests $5k a year from 25-35 and then stops investing. Investor 2 starts at 35 and invests $5k a year for the next 30 years.

Amazingly Investor 1 ends up with over $160k more at the time of retirement in this case 65. This is assuming 8% growth rate per year in assets.

Private / Workplace Pension schemes:

Most employees have a workplace pension. Under this system, both the employer and employee make contributions, which need to add up to a minimum of 8pc of your pre-tax salary (3pc from the employer, and 5pc from the employee). Many employers will pay in more than this – and might also match your contributions if you choose to pay in more than 5pc. It is important that you have opted into your pension and seek, if you are able, to maximise your employer contributions.

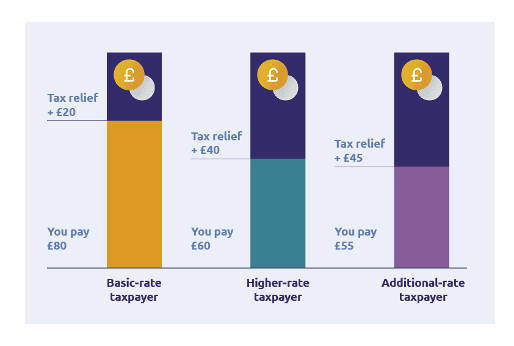

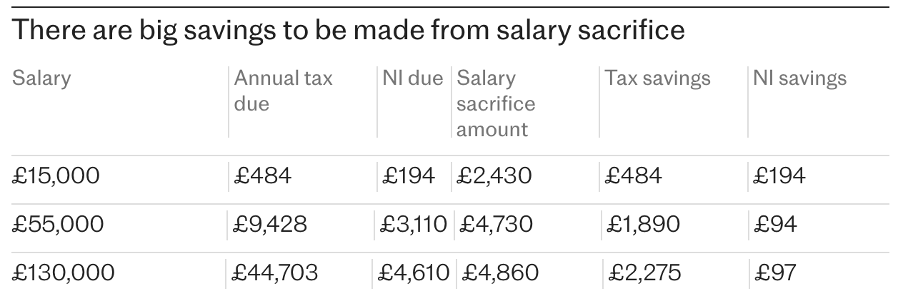

TAX RELIEF : Getting tax relief on pensions means some of your money that would have gone to the government as tax goes into your pension instead (saving of 20-45%) – You are investing money pre tax (from gross salary)

Even if they require you to contribute too, then, unless you can't afford to contribute or your priority is dealing with unmanageable debt, not maximising your employers contributions and forgoing tax relief is like turning down the offer of a pay rise.

It's worth paying into a pension to get that extra money to use later in life albeit at the expense of current spending power. Lowering our time preference investing in our futures is a key concept that we will talk continuously about in RIZQ Revolution.

Points to note:

- You can usually take up to a quarter (25%) of your pension savings as a tax-free lump sum.

- Generally, you can access the money in your pension pot from the age of 55, but this will increase to age 57 from 6 April 2028.

- The later you draw your pension will allow further growth in your final pot. But you need to look at your needs as you approach retirement.

How does Tax relief look like for various tax bands:

Paying £100 into your pension plan could only cost you as little as £55 depending on how much income tax you pay. You don’t get those kinds of tax benefits with any other savings product.

Paying into your pension is taken out of your gross salary (pre tax) so you receive full tax relief upto the highest rate of tax that you pay 20% as a basic rate tax payer, 40% as a higher rate taxpayer and 45% for additional rate taxpayers.

- You may be able to use pension contributions to lower your tax band and fall from being a additional rate tax payer to a higher rate taxpayer. This gives you full relief on your income.

- Check this handy guide to check how it works (free 1 month subscription to the Telegraph may be needed to access this – don’t forget to cancel it !). https://www.telegraph.co.uk/money/pensions/private-pensions/how-to-make-pension-contributions-to-lower-your-tax-bill/

Use your pension to claim more child benefit (and free hours)

From April, the threshold at which families started to lose child benefit increased from £50,000 to £60,000. This means you now have to repay 1pc of what you receive for every £200 someone in your household earns over £60,000.

However, by making pension contributions to fall below £60k, you can lower your net income and have to repay less child benefit – or none at all.

Self Employed / Limited companies also get pension tax relief:

Just 16% of self-employed workers pay into a pension, causing millions to retire without adequate savings.

Sole traders get a 25% tax top up from the government on personal pension contributions in most cases; for every £100 you pay in, the government adds £25. If you’re the Director of a limited company, company contributions may be considered an allowable business expense and could be offset against your company’s corporation tax.

If you fall into this category it is vital to maximise these tax savings and seek financial and tax advice to set up your pension schemes!

Where is my money invested:

Although each pension provider takes a slightly different approach, the default allocation of your pension pot will be a range of assets as shown in the table below.

The younger you are generally equates to a higher risk tolerance. You have more time on your side to be invested in higher risk / higher volatile assets such as stocks. The higher the growth the rate the higher the compounding effect.

The example below shows Aviva's 3 risk bands – This is just a basic guide to give some insights where your default money is invested.

|

Pension Fund Name |

Risk Level |

Equities |

Fixed Income |

Real Assets |

Cash & Equivalents |

|

Aviva Pension Fund Low Risk |

Low |

40% |

50% |

5% |

5% |

|

Aviva Pension Fund Medium Risk |

Medium |

60% |

30% |

5% |

5% |

|

Aviva Pension Fund High Risk |

High |

80% |

10% |

5% |

5% |

How can I make my Pension Halal (Shariah compliant)

Notice that for all the plans above you are investing in Fixed Income (bond) markets – this means we are lending money to governments to fund their campaigns. More on bonds in our article on banks:

The stocks in the equity portion are generally tracker funds which will include all companies these may include companies which make money from Non Shariah compliant forms of business and companies which support causes that don't align with your moral views.

What makes a stock Shariah Compliant:

- Ban on interest (Riba)

- Ban on uncertainty (Gharar)

- Ban on speculation and gambling (Maisir)

- Risks and profits are shared among all parties

- Ethical investments that enhance society i.e. not investing in tobacco, arms and alcohol)

- Underlying assets must be tangible and identifiable

At the moment the shariah compliant funds are managed by traditional finance asset managers such as HSBC, Fidelity, Vanguard, Blackrock etc:

They might not be perfect and fulfil all the ethical issues we face as Muslims BUT they are at least a step in the path of ensuring our funds are not contributing to companies which are known to be profiting from haram activities.

Shariah Compliant ETFs:

To give an illustration of how some Shariah compliant funds have performed over the last 5 years

While these exact funds may not be available in your pensions they provide an example of the returns we have seen in recent history.

|

Fund Name |

Ticker |

Fees (%) |

1y Perf (%) |

5y Perf (%) |

|

iShares MSCI World Islamic ETF |

ISWD.L |

0.5 |

15.2 |

65.8 |

|

Xtrackers MSCI USA Islamic ETF |

XUIS.L |

0.4 |

14.3 |

60.1 |

|

HSBC MSCI ACWI Islamic ETF |

HSGB.L |

0.45 |

12.8 |

55.2 |

Other funds to consider are commodity funds (gold, silver) which maintain purchasing power vs currency debasement (a concept we will explore further in RIZQ Revolution).

YOU can request to amend your allocations:

Step 1 – Find out who is your pension provider from your work place – For example – Aviva, Legal&General , Fidelity , Nutmeg etc.

Step 2 – gain access to your online pension account – this will also have useful pension calculators so you can see how much your pot is predicted to be at the end.

Step 3 – Amend fund allocation – you can adjust where your pension funds are held –

- Look for shariah compliant equity funds available to you.

- Consider removing the investments in Fixed Income Bond markets.

- Look for possible allocations to gold / commodity prices to provide a hedge in your allocation

What else can I do / points to note.

- Check that you are maximising your employers contributions.

- Generally, your employer will allocate a set % based on your contributions – make sure you are maximising what they will give you based on your contributions (Don’t give up this free money!)

- Details can usually be found on your company website (intranet) or employee handbook .

- Consider consolidating your existing pensions into 1 easy to manage Pension pot

- If you have multiple pension schemes from several prior employers – you can request to transfer your pensions into your current provider – this will make fund allocation easier to manage and forecasting your pension pot easier.

- Before doing this make sure you have someone to assess as their maybe benefits in your prior pensions (defined benefit, life and critical insurance etc) which may outweigh consolidation.

- If you are self employed / own a business – investigate how you can make tax free contributions from your earnings into your pension (SIPP) to qualify for tax relief from the UK government.

- Ensure that any beneficiaries that may be entitled to funds from your pension are nominated and approved by your pension provider.

Disclaimers:

- This pdf is not designed to provide tax or financial advice rather just pointers on how to go about making tax efficient contributions.

- The contents of this presentation should not be considered to be legal, tax, investment or other advice, and any investor or prospective investor considering the purchase or disposal of any investment should consult with its own counsel and advisers as to all legal, tax, regulatory, financial and related matters concerning an investment in or a disposal of such investment and as to their suitability for such investor or prospective investor.

- For further information please talk to an authorised and regulated independent financial advisor.

Member discussion