5-Steps to Financial Freedom

In this short blog, we aim to provide a template for resetting your financial behaviours. In essence, the plan is simple.

Income > Expenditure = Savings & Investments = A path to financial freedom

How do we raise our income while reducing our expenditure, and what do we do with our surplus funds?

Any excess in this straightforward equation is what goes into our wealth-building pot. This is money we are saving and investing for our long-term futures and to improve our overall financial well-being.

Below, we outline a 5-step pathway to protecting our financial futures, tying together many of the themes discussed previously on this blog.

Step 1: Budgeting: Is your Income > Spending?

Step 2: Basic Emergency Fund: Building Resilience

Step 3: Clearing Debt: Remove The Wealth Handbrake

Step 4: Fully Funded Emergency Account

Step 5: The Wealth Creation Phase

New Year's provides us an opportunity to reset and to make changes in our behaviours that will improve our financial well-being for years and decades to come.

It is never too late to start on this journey and no amount is too small. Even small short-term sacrifices can have a profound impact in future when compounding is on our side. We appreciate that costs are higher than ever, so spare cash for saving and investing is harder to come by.

Remember that we will (hopefully) not be working forever, and in our peak years of earning, is when we should be preparing for our futures.

Step 1: Budgeting: Is your Income > Spending?

Before we can begin the journey of saving, investing and debt clearance, we must become hyper-aware of our income and expenditure situation. This involves a deep analysis of our bank statements and financial health.

Often, the hardest step is to analyse and acknowledge our current financial situation (ignoring it is no longer an option)

The ultimate goal is to have income > expenses. When we have a surplus in our monthly budgets, we can begin to focus on our futures and eventually let compounding and asset appreciation work in our favour.

Budgeting means we are no longer guessing about where our money is going, it means being conscious of where the leaks in our current systems are.

What’s Coming In

Write down all the income you have coming in monthly (paychecks, side hustles, babysitting, everything) and add it up. This is what you have to work with to cover your expenses for the month.

What’s Going Out

This might take some time, but log into your bank account and take a look at the past three months. Group each transaction into categories like giving, rent/mortgage, bills, groceries, uber eats and your money spent on pleasure. Then add up each category and divide by three so you have a rough average of your spending each month.

The Hard Part

Once you see where your money’s going, you’ve got to be honest with yourself - can you afford this lifestyle, or do you need to make changes?

Relief will come from the little choices. It means brewing coffee at home for 25p a cup. Sure—it’s not fancy. But financial peace is a high no pumpkin latte can top.

Good short-term behaviours allow you to increase future consumption guilt-free.

This exercise is critical for all people, regardless of their perceived finances and should be repeated at least twice a year.

This is the signal to cancel that subscription you rarely use!

Step 2: Basic Emergency Fund: Building resilience

We must first build a savings pot of 1 month's expenditure that is instantly accessible.

The aim must be to do this step as soon as possible - it provides short-term security and shows what is possible.

Psychologically, having this small buffer gives us confidence to continue on the journey and shows what is possible.

In this step, to speed things up, you may for example look to raise funds from selling things in your home you no longer use and sacrificing expenditure from your budget to raise a small emergency balance. Speed in this step is critical.

This step isn’t about being ready for any possible emergency—it’s about breaking the old habit of relying on debt in an emergency. Your basic emergency fund turns what used to be a financial crisis into a minor inconvenience.

Step 3: Clearing Debt: Remove The Wealth Handbrake

Society has tricked us into thinking that personal debt is normal and often even encourages it.

Personal debt (outside of mortgages) is one of the biggest hurdles to wealth creation. Generally, personal debt that is taken for consumption(e.g cars, holidays, Klarna and credit cards) comes attached with high interest rates and is money that is borrowed to buy depreciating assets.

This debt snowball acts as a handbrake on your ability to save money over time. With interest compounding, the total repaid amount can lead to many multiples of the original amount borrowed.

By paying these debts off with excess cash every month, we can begin to remove the financial burdens. This is why debt reduction comes before a fully funded emergency account.

Tips:

- Pay off the debt with the highest interest rates first. In this step, we want to maximise the amount we repay per month. Every pound repaid today reduces our overall interest burden.

- Maximise repayments on your highest interest debt while making minimum payments on your cheaper debts.

- Consider consolidating debt to make it more manageable to potentially reduce your interest rate.

- Speak to debt advisory charities for advice:

Step 4: Fully Funded Emergency Account:

Now that our expensive debt is repaid and interest payments are no longer a burden, we must fund a larger instant-access emergency fund that covers 3-6 months of expenses. This is a fully funded emergency account that means that tough times like a job loss won’t send you back into debt.

This gives comfort, security and some buffer against unforeseen circumstances so that we can have confidence in building financial security.

Keep the momentum from step 3 making sure that your surplus funds are going into savings rather than consumption, the fun is about to begin...

Tips:

- If you have a steady job, aim for 3 months. Does your paycheck vary? Save a 6-month fund. Personalise it to fit your life’s needs

- Keep your fully funded emergency account in a high-yield savings account that is easily accessible.

- https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/#easyaccess

Step 5: The wealth Creation Phase:

By getting to step 5, you have overcome the hardest part of the process. From this point in your journey, your lifestyle and financial behaviours are focused and fine-tuned. You have made noticeable changes to your lifestyle, and you begin to understand what is possible in your budget.

From here, we get to let our money work for us!

The money you used to build an emergency fund and pay off expensive debts in steps 2-4 is now what will make up your savings and investments.

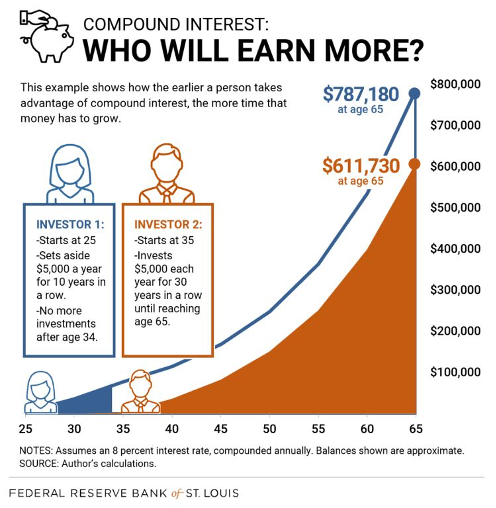

From this stage, compounding begins to work in your favour, and we can aim to beat the plague of debasement & inflation.

Understanding compound growth is critical as we explained in the following article: Compound growth - The 8th wonder of the world

These investments should be viewed as medium- to long-term investments targeting capital growth over 3+ years. Yes, they can be volatile, but over longer periods of time, assets appreciate.

One of the most powerful strategies for building long-term wealth is dollar cost averaging, a technique that involves investing a fixed amount of money at regular intervals, regardless of the market's performance. By doing so, you're able to reduce the impact of market volatility on your investments, as you're not trying to time the market or make emotional decisions based on short-term fluctuations. Instead, you're systematically investing in the market, taking advantage of lower prices during downturns and higher prices during upswings. This approach also helps to eliminate the risk of investing a large sum of money at the wrong time, which can be a major obstacle to achieving long-term financial success.

The following investment options only provide a very brief overview of the options that are available. They aim to give you a starting point to begin your research on investment ideas and should not be taken as financial advice.

Areas of investment to focus on to build wealth:

Pensions:

- The most tax efficient ways to build long-term security for retirement. Money invested in pensions are pre tax, and so you get an immediate uplift to your investments.

- Pensions allow you to invest in funds that track the stock market, gold and other liquid assets.

- We discussed in Your Pension Is Funding Genocide — Here’s How that bonds are an investment vehicle that we should generally avoid as Muslims.

- Pension funds are, however, not accessible in the short term, so we can not just rely on this as a form of investment.

Stocks and Shares ISAs:

- Stocks and shares ISAs are a great way to build assets over time with any capital gains or income (dividends) earned free of tax. Current limits are £20k per person per year.

- Low-cost ETFs are often considered foundational building blocks for long-term portfolios, helping investors grow wealth efficiently and sustainably.

- ETFs offer broad diversification, allowing investors to gain exposure to a wide range of assets—such as entire market indices, sectors, or commodities—with a single purchase. This diversification reduces risk and supports more stable long-term growth.

Gold:

- Gold has stood the test of time as an asset that appreciates consistently over time - hard money that can't be easily produced and combats inflation. In the last year, Gold has been one of the best-performing assets, moving 70% higher in price!

- Gold can be purchased in both your ISA as an ETF or in physical form that you self-custody.

Bitcoin:

- Bitcoin plays a crucial part in our portfolios particularly given the state of the world. Bitcoin protects us from the following as we explained in detail in the following 2 articles:

- Currency debasement

- Sovereignty of money

- Seperation of money & state

- Privacy

Why Does Investing Work?

Stocks = All-time High in 2025

Gold & Silver = All-time High in 2025

Bitcoin = All time high in October 2025.

Cost of Living = All time High in 2025

Over the past 24 months, since this blog was launched, the debasement train has roared on. Inflation continues to rise above target, driven by consumer goods such as food and energy, while asset prices have skyrocketed, driven by AI hype & increasing money supply.

Unfortunately, this set-up further widens the income equality gap as those invested in assets have outperformed inflation, whilst those continuing to save in cash continue to be worse off through a reduction in purchasing power.

Given the level of debt in the system, this trend has been inevitable - the only way to repay the prior loans is to devalue the currency in which it is owed via monetary inflation.

So what happens next and what do we do?

The long-term pathway is clear. Hard money and assets should continue to perform better than savings in a devaluing currency.

Giving Back

Prosperity (financial wealth in this context) is both a blessing and burden from God, wealth is granted from the creater and we as humans living on this Earth are stewards for its disposal.

Yes, our lifestyle and quality of living can go up but to a point where we are still living a modest and humble life that is not excessive in any aspect.

Wealth accumulation allows us to give back to humanity and society through charitable endeavours.

In the Quran Allah beautifully talks about the compounding returns for our acts of charity. In our plan to grow our wealth and move closer to financial freedom, charity and giving back to others will be a key driver to our success.

"The likeness of those who expend their wealth in the way of God is as the likeness of a grain of corn that sprouts seven ears, in every ear a hundred grains. So God multiplies unto whom He will; God is All-embracing, All-knowing." (2:261)

The Future is in your hands

In conclusion, achieving financial freedom is a journey that requires patience, discipline, and a willingness to make meaningful changes to our financial behaviors.

By following the 5-step plan outlined in this post, you can take control of your finances, break free from the cycle of debt, and start building a secure and prosperous future.

Remember, it's not about making drastic changes overnight, but about making small, incremental adjustments that add up to significant gains over time.

Member discussion